Top officials of the Reserve Bank of India (RBI) have raised fresh allegations and concerns over Stablecoins and other crypto pegged to the US dollar. The officials presented the allegation over the fear of dollarization of the country’s economic system.

The RBI warned the parliamentary body that if Stablecoins are allowed in India, they could affect the country’s financial system by affecting the power of the Central Bank to control fluctuations and volatility of domestic currencies.

They continued, “a serious blow to the financial system will come when companies or traders turn to Stablecoins for domestic payments.“

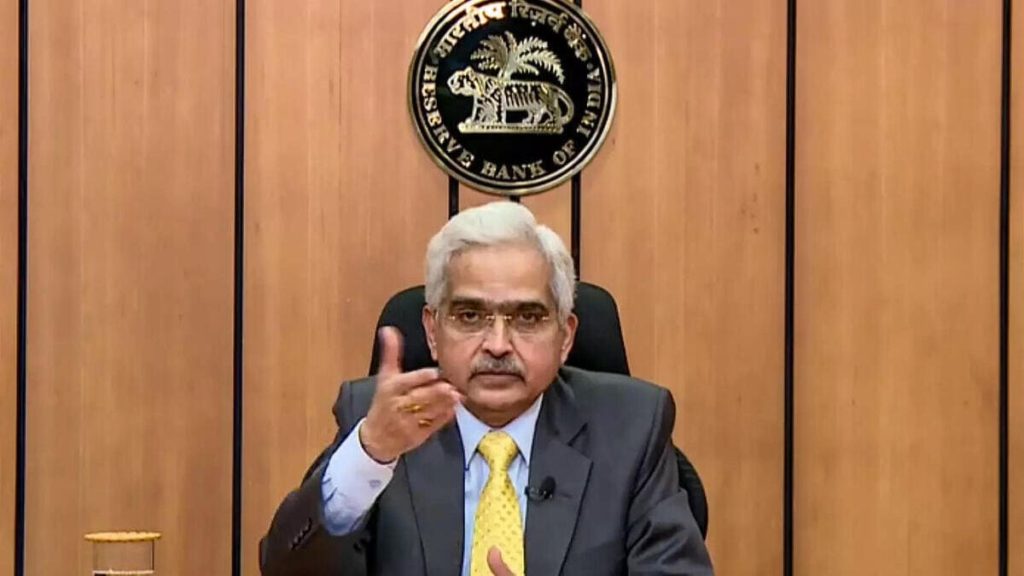

According to the PTI report, the Governor of the RBI, Shaktikanta Das, with the top officials of the institution briefed the Parliamentary Standing Committee on Finance led by the former minister of state for finance Jayant Sinha, expressed their fear over the challenges Stablecoins can pose to the country’s financial system. A panel member quoted the RBI that “Stablecoins will undermine the RBI’s capacity to determine monetary policy and regulate the country’s finical market and economic system.”

RBI clearly explained that cryptos having the potential to become the domestic means of exchange in the country and sabotage the Rupee in the global market could hinder the RBI’s capacity to regulate the flow of money in India’s economic system.

Financial regulators have been struggling to formulate policies against Stablecoins because not only could they undermine the domestic currency of a country, but they also facilitate terror financing, money laundering and drug trafficking. Thereby posing a bigger threat to the country, not only financially but also to the country’s security.

Mihir Gandhi, partner and leader, payments transformation, PwC India, said, “If Indians are allowed to buy Stablecoins, store them or even invest in them, then that can threaten and sabotage the Indian Rupee to a large extent. Worse, the RBI will not have any control over such cryptocurrency and will not have visibility over how it’s used and by whom, unlike in the case of buying USD directly.“

Impacts on the Banking System

Discussing the negative impacts of Stablecoins on the banking system, the RBI officials said that Stablecoins are attractive and stable assets. People may invest their savings in these resources, leaving the bank with less capital to lend.

Recently, Indian crypto investors are turning towards Stablecoins paired with US Dollars to save their money against the volatility of other cryptocurrencies. Stablecoins like Tether (USDT), USD Coin (USDC) and Binance (BUSD) pin their value to the US dollar with a 1:1 conversion rate and are designed to keep the value stable. Since crypto is fighting bulls and bears against volatility in the market, Stablecoins might be the right solution to save in crypto; however, it harms the country’s banking system.