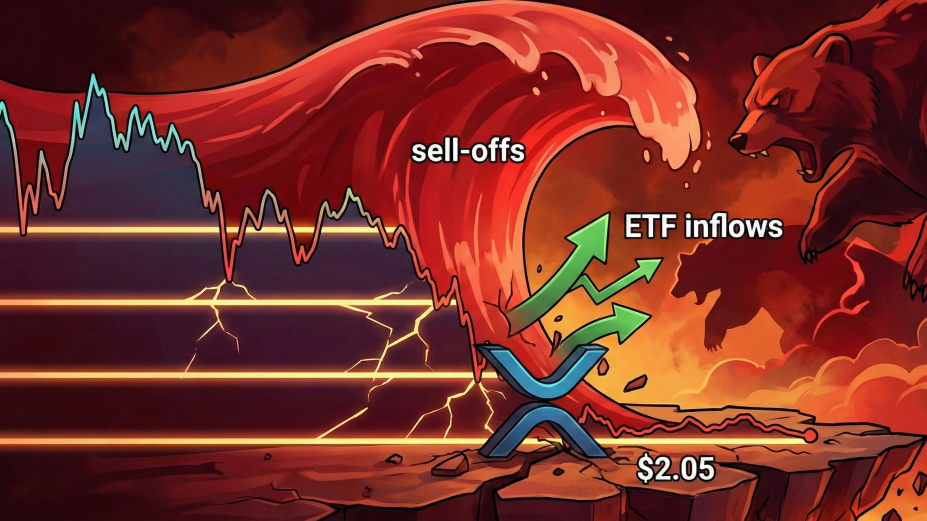

The start of December has brought a strong correction for Ripple, causing its valuation to descend drastically from $2.21 dollars to touch worrying lows. According to data analysis presented by Shaurya Malwa, this abrupt XRP price drop of 7% responds to a violent wave of institutional selling that managed to dominate the market. This bearish move occurred this Monday, momentarily nullifying the optimism generated by recent capital flows into exchange-traded funds.

Hard data reveals a notable disconnect between institutional infrastructure and short-term price action, creating a complex scenario for investors. Although XRP ETFs recorded impressive inflows of $666.6 million dollars this month, led by 21Shares, the market could not sustain the level. Trading volume spiked to 309.2 million, a figure that represents 4.6 times the rolling average, confirming that institutions opted to exit their positions aggressively during the afternoon session.

Will institutional flows be able to stop the descent towards $1.80 dollars?

On the other hand, technical analysis shows that the asset broke a vital consolidation structure by losing the $2.16 dollar mark. This level had functioned as a crucial pivot during the last three weeks, so its breakdown signals that sellers have regained control. Likewise, the formation of a descending channel with consecutive lower highs at $2.38, $2.30, and $2.22 dollars reinforces the bearish thesis. Currently, market liquidity has thinned significantly, accelerating the decline while momentum indicators show no clear divergences for immediate recovery.

However, there is an underlying phenomenon that could offer a glimmer of hope for long-term holders of these cryptocurrencies. While the price plummeted, whale wallets took the opportunity to accumulate, adding 150 million XRP tokens since November 25. Nevertheless, this massive accumulation was not enough to counter the derivatives liquidation. If the psychological support of $2.05 dollars does not hold firm, it exposes the November demand band situated between $1.80 and $1.87 dollars.

Finally, traders must watch the asset’s behavior with extreme attention in the coming hours to validate any attempt at a bounce. Reclaiming the $2.16 dollar level is an indispensable requirement to invalidate the current bearish structure and resume the path of sustained growth. Otherwise, if selling pressure continues to intensify without buying volume to back it up, we could be facing the start of a deeper correction towards new lows before the year ends.