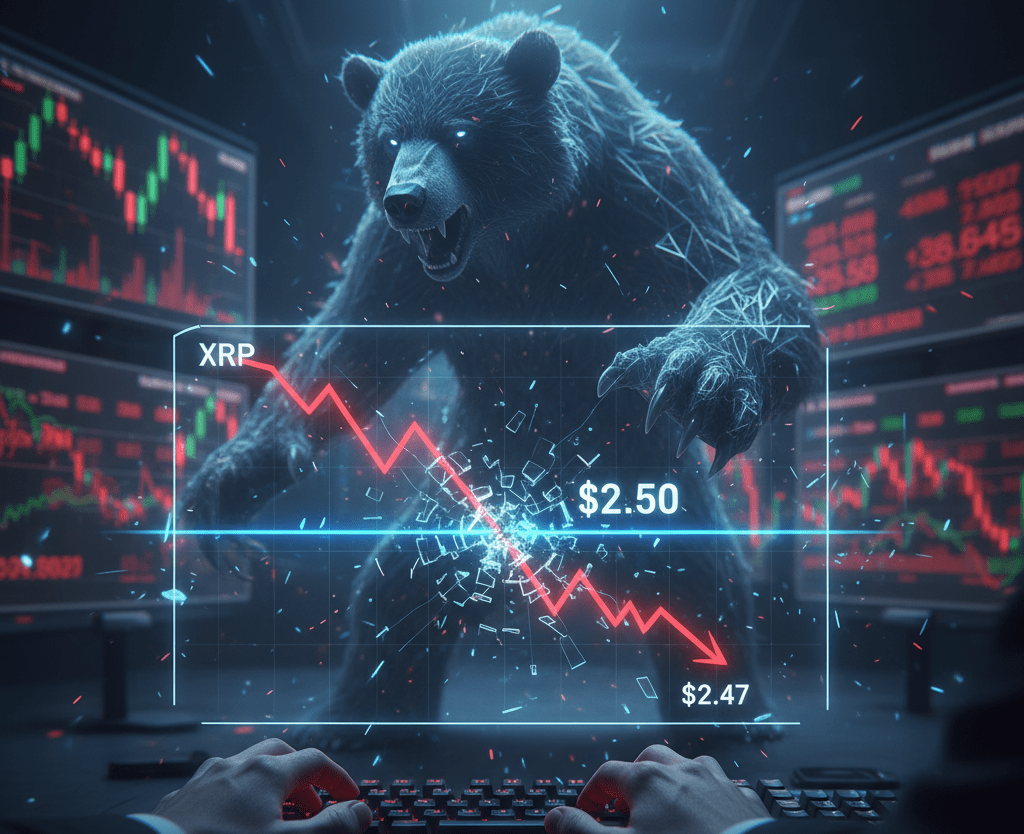

XRP’s price registered a significant 5% drop this Tuesday. The cryptocurrency pulled back to $2.47. This move occurred after institutional selling pressure caused XRP breaks $2.50 support, a key psychological level. Market data, analyzed by CD Analytics, confirms a decisive shift in the asset’s structure.

The sell-off unfolded in structured phases during Tuesday’s session. The initial drop began at 13:00 UTC. High sales volume pushed the price below support, triggering a cascade of sell orders. This drove the asset to intraday lows near $2.38. Total trading volume reached 169 million tokens. Subsequently, the price achieved a slight stabilization. A temporary range formed between $2.43 and $2.46, suggesting the early stages of a possible consolidation.

The impressive 158% spike in trading volume is fundamental. It confirms institutional participation in the sell-off. It does not appear to be a retail panic liquidation. The break of the $2.50 level was significant, as it unleashed a wave of algorithmic and institutional selling. Furthermore, this underperformance by XRP contrasts with the general strength of cryptocurrencies. This suggests a rotation away from altcoins as the appetite for speculative risk diminishes.

Can the $2.40 Level Stop XRP’s Slide?

This price drop marks a continuation of the bearish structure. The asset is showing lower highs and lower lows since it failed to retest the $2.60 resistance. The 8.8% volatility recorded in the session underscores the aggressive liquidation. Momentum indicators, such as the RSI, have entered neutral-to-bearish territory. Likewise, the MACD is showing increasing bearish divergence. The $2.40 to $2.42 zone now acts as immediate technical support. Analysts warn that a close below this band could open the door to a further drop. The next target would be in the $2.30 to $2.33 zone.

Overall sentiment in the derivatives economy remains cautious. Data shows a decline in open interest and modest upticks in short exposure. Traders are closely watching whether the $2.43 to $2.46 level can stabilize. If, on the contrary, a clear break below $2.40 accelerates the capitulation. To neutralize the bearish momentum, XRP would need to reclaim the $2.50 level. Until then, rallies are likely to be met with supply from trapped long positions.