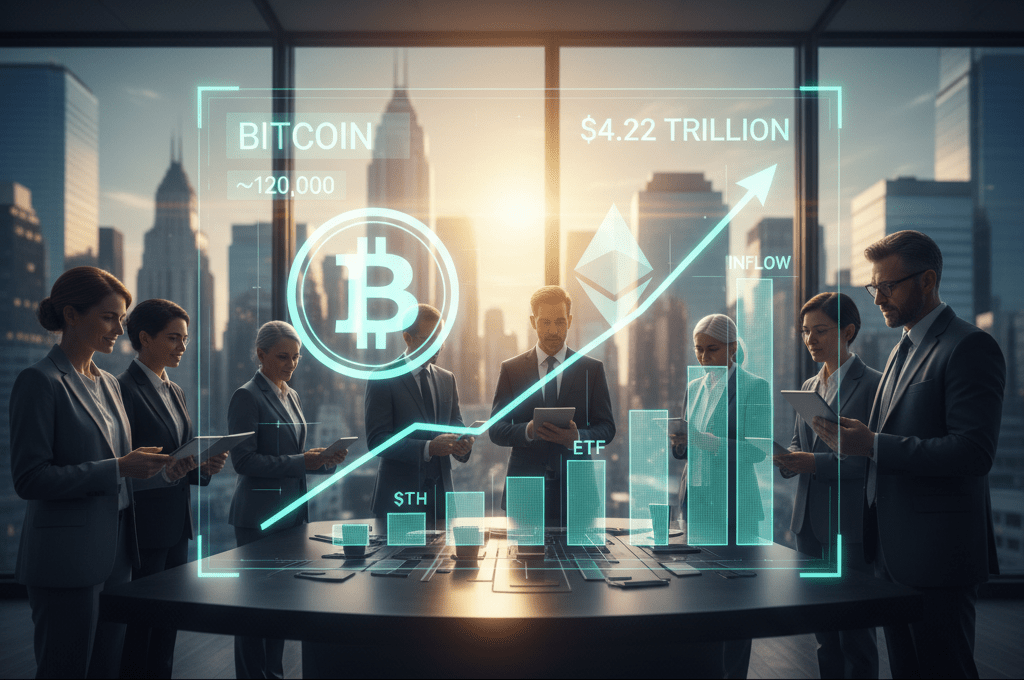

The cryptocurrency market is experiencing a notable recovery this Friday, October 3, driven mainly by a continuous capital inflow into exchange-traded funds (ETFs) for Bitcoin and Ethereum in the United States. According to market data, this investment flow has sustained positive sentiment among investors for the fourth consecutive day, pushing the sector’s global capitalization above $4.22 trillion.

The day shows green numbers for the main digital assets. The price of Bitcoin (BTC) registered a 1% increase, while Ethereum (ETH) shows a 1.5% rise. This behavior reflects the confidence that institutional and retail investors are placing in regulated products, which facilitate exposure to cryptocurrencies without the need for direct custody. The steady flow of investment has been a key catalyst.

A bullish October on the horizon?

The market has reacted positively to the strong capital inflow into exchange-traded funds, a factor that consolidates the sector’s maturity. Historically, October has been a favorable month for Bitcoin, creating expectations for a possible bullish performance in the coming weeks. Analysts point out that the demand for spot ETFs not only validates cryptocurrencies as a legitimate asset class but also stabilizes their long-term volatility.

Additionally, the improvement in overall market sentiment is palpable. Investor confidence is significantly increasing with each day of positive net inflows into these funds. This phenomenon is crucial as it suggests a more solid foundation for sustained growth, differentiating it from past speculative rallies. The digital economy is strengthened by these regulated financial instruments.

The impact on prices and outlook

Although the current outlook is optimistic, various analysts recommend caution. The momentum generated by the capital inflow into exchange-traded funds could face a short-term consolidation phase. Prices may stabilize as the market absorbs recent gains before defining a new trend. This consolidation could be healthy to prevent overheating.

The medium-term outlook, however, remains positive. Institutional participation through ETFs is an indicator of large-scale adoption that could mitigate sharp declines. Investors will closely monitor the evolution of capital flows in these products, as they have become a fundamental barometer for measuring the traditional market’s interest in the crypto ecosystem.