The CEO of the crypto company BCB Group claims that today's rise in the price of Bitcoin was caused by one investor who distributed $ 100 million across three large cryptobirds .

In a conversation with Reuters, Oliver von Landsberg-Sadie said that transactions totaling about 20,000 BTC at the same time on Coinbase, Kraken and Bitstamp caused a breakthrough of the BTC rate above $ 5,000 .

“There was one application, algorithmically distributed among the three platforms, by about 20,000 BTC. If you look at the volumes of each of the three exchanges, you can see the simultaneous appearance of applications for 7,000 BTC, ” he said.

Crypto-analyst DataDash believes that over time, the holders of Bitcoins , managed to accumulate large amounts of cryptocurrency through OTC transactions will be an incentive to start moving up the price on the spot market.

“We need to understand that in recent months, over-the-counter buyers had a good opportunity to finally start accumulating bitcoins at lower levels. As soon as their incentive becomes large, as soon as their share in the Bitcoin markets becomes sufficient, as soon as they form their long-term positions, they will be motivated to trade on the spot market. That is, they will start clearing the book of applications and increasing their positions in the spot market, she said.

Why do they need it? On the over-the-counter market, they have built up much larger positions, without causing price fluctuations. Now they are motivated to move the price up, to buy more bitcoins on the exchanges, on most major exchanges, perhaps around 50,000 – 60,000 BTC. This will increase the value of their much larger positions. This can really happen in the cryptocurrency market, regardless of whether people think this is right or not. ”

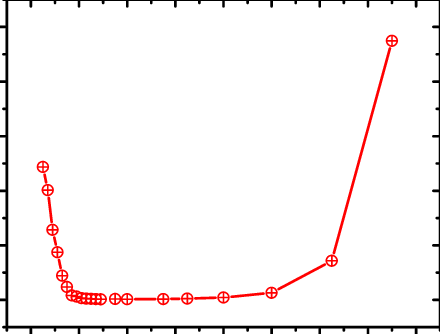

When forecasting the further development of the situation, DataDash recommends looking at a possible decline after today's jump:

“If we lose more than 50% of this movement, then I would start worrying and talk about a false breakthrough. I’ll be a little bullish if we close below the 200-day moving average. Closing the daily candle below $ 4,714 will not be a very positive factor. ”

Publication date 03/04/2019

Share this material on social networks and leave your opinion in the comments below.