The United States Commodity Futures Trading Commission (CFTC) plans to give the go-ahead to launch futures contracts at ETH, CoinDesk reports on this, citing information from a representative of the agency. Against the background of this news, the ETH rate has increased by approximately 10%

Earlier, the CFTC, which regulates derivatives markets in the United States, approved the launch of Bitcoin futures contracts. Since the end of 2017, derivatives of the flagship cryptocurrency have been trading on the CME and CBOE platforms. Now, the American regulator is ready to consider launching a similar tool for Ethereum, the coin that ranks second in the cryptocurrency rating for market capitalization. The representative of the CFTC, who wished to remain anonymous, said that the agency is likely to be able to accept the fact that there will be derivatives associated with ETH under their jurisdiction.

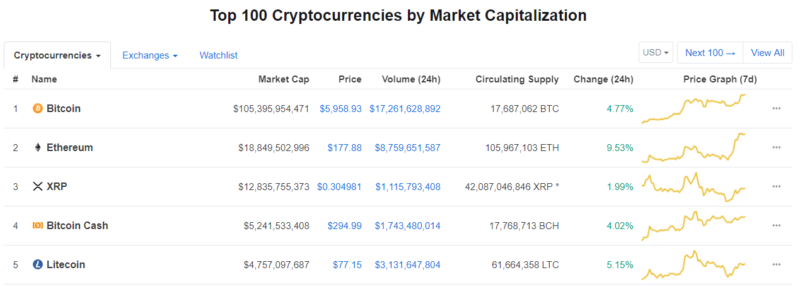

Source: CoinMarketCap

Source: CoinMarketCap

So far, we cannot talk about any specific decisions, but according to the data from the representative of the CFTC, if any derivative platform contact the agency with an offer to launch a particular product that meets the established requirements, there is a high probability that issued by It is noted that the CFTC will respond only to specific applications, in general, the agency does not intend to express its opinion on derivatives related to ETH.

In the event that an offer to launch ETH futures is received and it is approved, institutional investors will also have access to the Ethereum market. John Todaro, head of digital financial instruments research at Tradeblock, notes that the emergence of such a financial product will provide hedge funds with the opportunity to work with ETH without worrying about cryptocurrency storage. This is important, because it is the question of custodial services for digital currencies that bothers many major players. In addition, this may affect the decision of the US Securities and Exchange Commission (SEC) to launch the ETF, and also have a positive impact on retail investor sentiment.