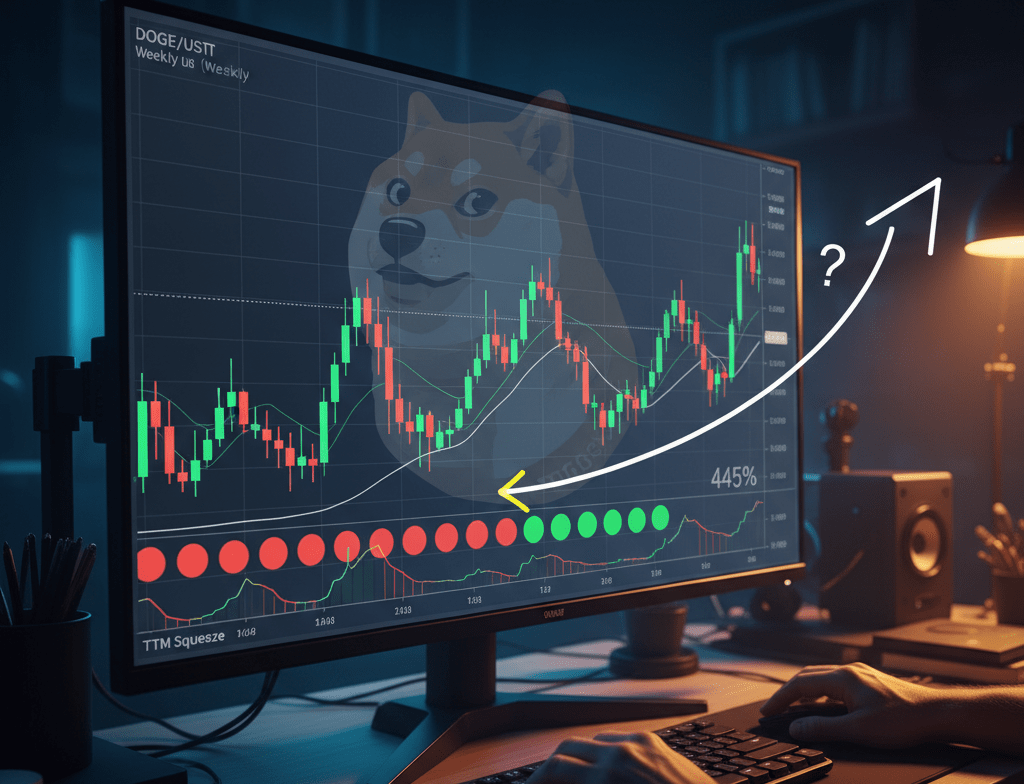

A key technical indicator for Dogecoin has once again flashed a bullish signal, capturing the attention of market investors and analysts. According to technical analyst Ali Martinez, the TTM Squeeze indicator on DOGE’s weekly chart is showing a compression that has historically preceded explosive price movements. This same signal was the precursor to an extraordinary 445% rally in the past.

Is Dogecoin Gearing Up for a New Rally?

The TTM Squeeze tool is used by traders to identify periods of low volatility, known as a “squeeze,” which are often followed by a sharp price expansion. Martinez highlighted this activation in his recent analyses. When the indicator shifts from red dots to green, it suggests that market energy is building up for a significant move. The last time this pattern similarly manifested, the meme coin’s price experienced massive growth.

This analysis focuses on historical price action as a potential roadmap for the future. Furthermore, the current cryptocurrency market context, with renewed interest in higher-cap assets, could be the catalyst Dogecoin needs. The community is closely watching these developments, waiting to see if history repeats itself and the cryptocurrency manages to capitalize on this technical signal to begin a new sustained uptrend.

Market Implications and Outlook

If the historical pattern holds, Dogecoin could be facing the possibility of a substantial rally, although past performance does not guarantee future results. Investors are closely monitoring the $0.18 level as a key resistance; breaking it could confirm the start of a bullish breakout. This movement would validate the signal from the TTM Squeeze. The market’s behavior in the coming weeks will be crucial in determining the asset’s final direction.

A potential Dogecoin surge could also have a ripple effect on other meme coins, revitalizing interest in this niche of the digital economy. For now, technical data offers an optimistic outlook but should be considered alongside fundamental factors and overall market sentiment. The current structure suggests that traders are positioning themselves for increased volatility in the short to medium term.