In the course of the rapid growth of the first cryptocurrency, increased onlaying activity was observed during the current week. Thus, the number of unconfirmed transactions at some point exceeded 70 thousand, but at the moment this figure has dropped significantly – below 2000.

Data Blockchain.com

It should be noted that amid the filling of the memPule, the average transaction cost reached $ 2.32. The same indicators were recorded in February 2018.

The fall in the value of the miners' total income from commissions in the period from May 16 to 19, data from Blockchain.com

Despite the unloading of the memory, according to bitcoinfees.info, transaction fees are still quite high. The user must pay about $ 4.13 for inclusion in the next block, $ 4.11 for confirmation during the processing of three blocks, and $ 3.56 for six.

Data bitcoinfees.info

This problem, which is directly related to network scaling, has already been noticed by prominent members of the community.

The bitcoin mempool is paying now too much for a tx.

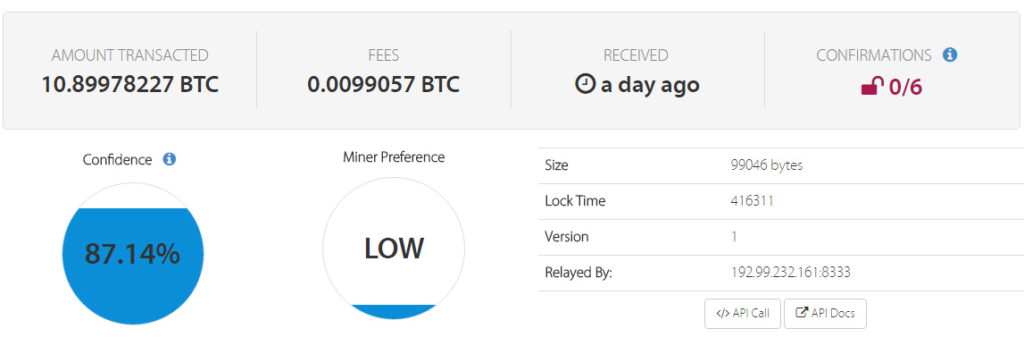

There are people overpaying like this. pic.twitter.com/3dQCh5Ffce– WhalePanda (@WhalePanda) May 19, 2019

Some users have stressed that this is due to inflated withdrawal commissions, which artificially establish exchange platforms.

Exchanges withdrawals overpaying. @BitMEXResearch , for example, charge a insane fee

– AD (@adzuardi) May 19, 2019

@coinbase @blockchain and @binance who intentionally block progress its

– Ozymandias⚡️??☄️? ฿ (@ nmeofdst8vM660) May 19, 2019

Meanwhile, 1036 BTC ($ 7.534 million) is transmitted through the payment channels on the Lightning Network.

#LightningNetwork https://t.co/Q0CaYRhLWD observed:

8,412 nodes (4,279 with active channels)

37,378 channels

1,036.618 BTC capacity ($ 7,534,288)median node capacity: 0.016 BTC ($ 119.11)

past 24h:

+20 nodes +172 channels -0.750 BTC ($ -5,451) #Lightning #LN #bitcoin $ BTC– Lightning Network statistics (@LNstats) May 18, 2019

Recall that today, May 19, the price of Bitcoin again surpassed the $ 8,000 mark, recovering from a sharp drop associated with a large order to sell 5,000 BTC on the Bitstamp exchange at a price of $ 6,200, which was sold on May 17.

Subscribe to the BlockchainJournal news in Telegram: BlockchainJournal Live – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news