As a result of the next recalculation of the complexity of mining Bitcoin, this figure fell by more than 15%, thus undergoing the second largest decline in the entire history of the first cryptocurrency.

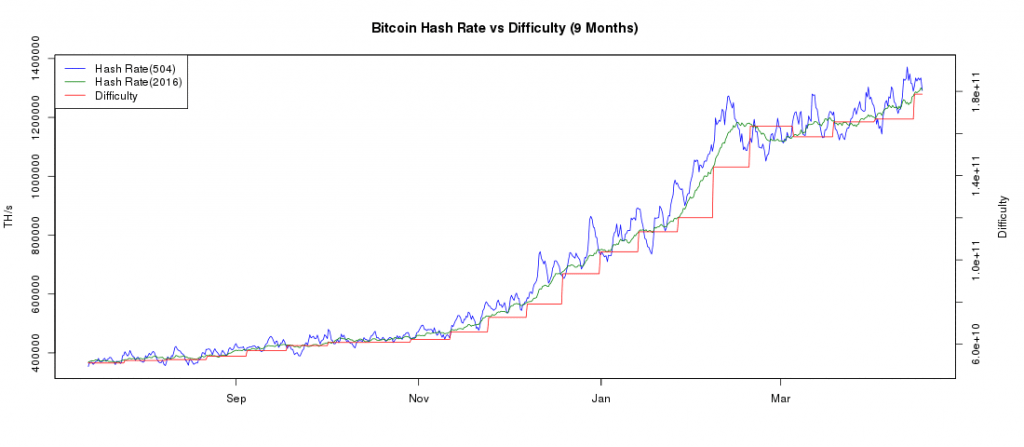

The complexity of mining is a parameter of the blockchain network, which shows how difficult it is to perform a mathematical calculation to find a new block and, accordingly, to receive an award for it. It is affected, among other things, by the network hashrate, that is, the total computing power of mining equipment involved in the process of cryptocurrency mining.

With a decrease in the hashrate, the complexity also falls, and this is exactly what happened as a result of its next recalculation. At the same time, this time the decline was extremely large, reaching 15.13%

The 275th Bitcoin mining period has started with block 552,384. ⛏ New difficulty: 5,646,403,851,534 (-15.13%)

– Bitcoin Block Bot (@BtcBlockBot) December 3, 2018

As XDEX chief analyst Fernando Ulrich noted, this is the second largest decrease in complexity in the entire history of Bitcoin and the largest since November 1, 2011, when this figure fell by 18%.

#Bitcoin had -15.1%. This is the current ranking:

2011-nov-01: -18.0%

2018-dec-03: -15.1%

2011-oct-16: -13.1%

2012-dec-27: -11.6%

2011-mar-26: -9.5%

2013-jan-26: -8.6%

2011-dec-01: -8.5%

2012-may-25: -9.2%– Fernando Ulrich (@fernandoulrich) December 3, 2018

The decrease in mining complexity was also recorded at the previous recalculation on November 18, and the last time before that it was observed on July 15.

Note that Bitcoin hash rate continues to decline – this indicator is in a downward trend since mid-October. The fall in prices only aggravated the situation, forcing many miners to turn off devices due to the unprofitability of mining. In terms of price, the break-even point is indicated differently – someone is talking about $ 7,000, in another opinion, this indicator is at the level of $ 4,500, below which Bitcoin has been trading around since November 20th.

It also draws attention to the fact that the hashrate indicator on the eve dropped to 37.7 EH / s – a drop of 39% compared to 61.9 EH / s, which was recorded at the end of August.

In the meantime, the price of Bitcoin, having fallen on a number of exchanges below $ 3,800 on Monday, shows signs of a slight recovery on Tuesday morning, rising to Bitfinex to $ 4,075.

Subscribe to the BlockchainJournal news in Telegram: BlockchainJournal Live – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news