In October, traders doubled the amount of open long positions in bitcoin futures from 500 BTC to more than 1000 BTC on the Chicago Mercantile Exchange (CME).

Long positions held by institutional accounts at the CME have been rising again in October.

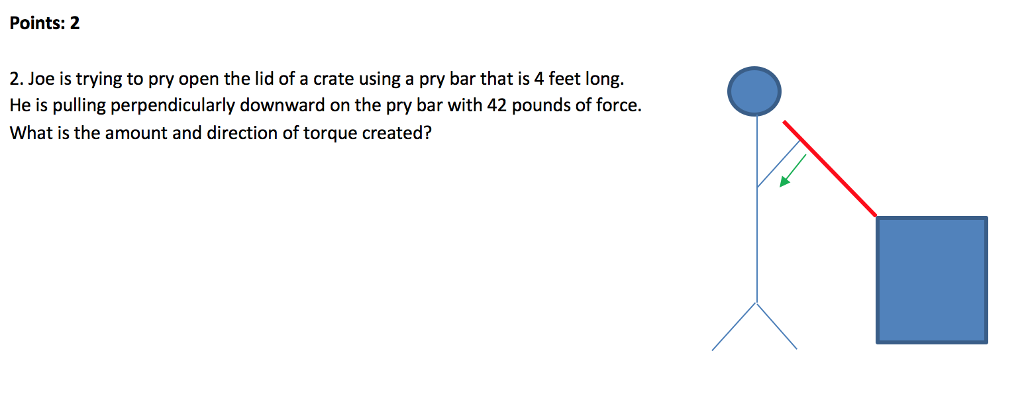

For reference, institutions include pension funds, endowments, insurance companies, mutual funds & portfolio / investment managers whose clients are predominantly institutional. pic.twitter.com/96N2XZwo9e

– skew (@skew_markets) October 20, 2019

In September, this figure reached 1300 BTC, but after launch Bakkt began to fall.

Earlier, CME reported a significant increase in the third quarter of the interest of large players in bitcoin futures. The number of open contracts exceeded the figure for the same period last year by 61%.

Recall that the company Grayscale Investments, according to the results of the third quarter, found that 84% of the influx of new investments in its cryptocurrencies was made up of institutional funds, mainly hedge funds.

Subscribe to the BlockchainJournal YouTube Channel!

BlockchainJournal.news

BlockchainJournal.news