CoinDesk analyst Omkar Godboul is sure that soon “ digital gold ” can overcome the $ 3,658 milestone. This will pave the way for Bitcoin's price to the psychological $ 4,000 mark.

According to his words , is gradually waning dominance of bears on the daily chart has formed a pattern of ascending correction "falling wedge". This figure has been forming for quite a long time – over the past six weeks, which indicates its relative reliability.

Currently, the first cryptocurrency is trading at around $ 3,400, which is about 20% below the December 24 high (near the $ 4,200 mark).

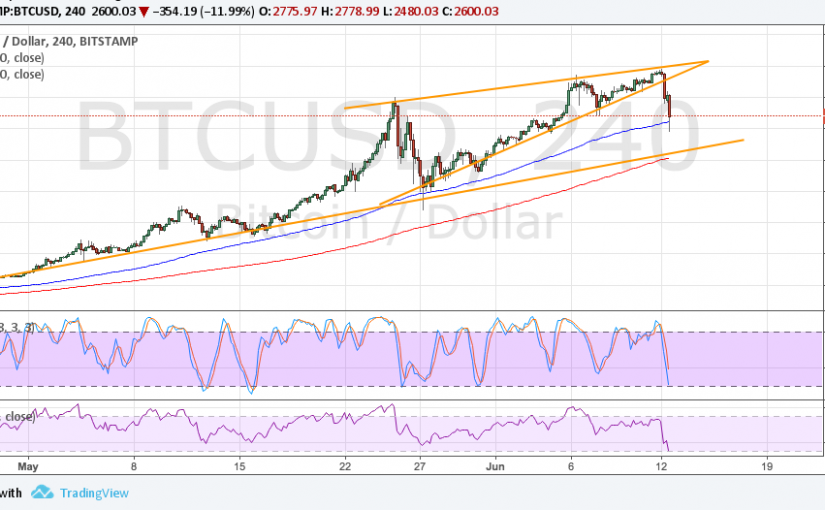

Daily and four-hour graphics

On the daily timeframe, you can see that the price of BTC is trapped within the bounds of the falling wedge pattern. In addition, on the lower timeframe it can be seen that the price inside the wedge moves in an upward channel.

The probability of breakdown of the upper boundary of the wedge at around $ 3450 will decrease if the price breaks through the lower boundary of the channel. Then the price is likely to go to the bottom of the figure at around $ 3,314

If, however, a breakdown of the upper boundary of the wedge occurs, the way will be opened to the level of $ 3,658, corresponding to the maximum of the “gravestone doji” candle formed on January 26th.

Weekly schedule

On a higher timeframe, moving averages with periods of 5 and 10 are directed "to the south", signaling a bear market. However, the volumes are falling, which indicates a decrease in sales pressure and a possible forthcoming triggering of the “Falling Wedge” pattern.

Earlier, Omkar Godboul came to the conclusion that February is usually a good month for Bitcoin.

Interactive Bitcoin schedule for the current moment:

Publication date 05/02/2019

Share this material on social networks and leave your opinion in the comments below.