Solana capital flows have plummeted to their lowest level in six months. This negative indicator coincides with the price struggling to overcome the $200 resistance. Investor confidence appears to be diminishing, increasing selling pressure on the digital asset. Key data from Glassnode and TradingView confirm this short-term bearish trend.

The Chaikin Money Flow (CMF) indicator is the main warning sign. Currently, the CMF is recording its lowest reading in half a year, which demonstrates significant liquidity outflows. This indicator measures buying versus selling pressure. On the other hand, exchange data, analyzed by Glassnode, shows a similar trend. The first notable net outflows in three weeks were recorded. This suggests investors are taking profits following the recent failed attempt to break $200.

The weakness in Solana capital flows is significant. It reflects growing caution among traders. After a strong upward rally earlier in the month, the asset has failed to maintain momentum. The lack of new capital entering the ecosystem limits the potential for a quick recovery. This situation puts SOL in a vulnerable position, as the blockchain relies on investor confidence to maintain its valuation. If broader market conditions do not improve, the bearish trend could intensify.

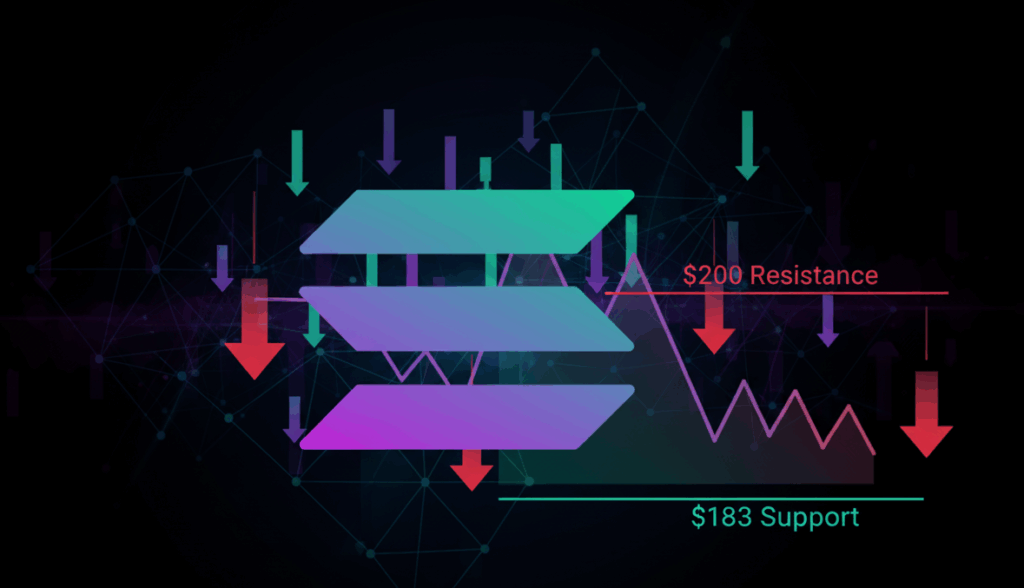

Will Solana Lose the Key $183 Support Level This Week?

Currently, Solana’s price is trading around $185. It is holding just above the critical support level of $183. If selling pressure, confirmed by Solana capital flows, continues, this support could break. A drop below $183 would open the path toward $175 as the next target. Some analysts even point to $170 if the weakness persists in the coming sessions.

However, the outlook for the asset is not entirely negative. If Solana manages to defend the $183 support and rebounds, it could attempt another assault on the $200 resistance. A successful close above that level would invalidate the current bearish outlook. Furthermore, breaking past $208 would strengthen bullish momentum and signal a return of investor confidence. Traders are closely monitoring these key levels.