Using the tools of the service Coin Metrics , IT-director of investment fund Point-Slope Capital Chris Rassi concluded that the price of Bitcoin is currently significantly underestimated.

Fun new chart from @coinmetrics . Regular $ BTC Network Value (circulating supply x price) is at ~ $ 60B, while Realized Cap is a NV of ~ $ 80B. The asymmetry suggests prices may have overshot downward pic.twitter.com/bQLlYXeXKZ

– Chris Russi (@chrisrussi) 14 December 201 p.

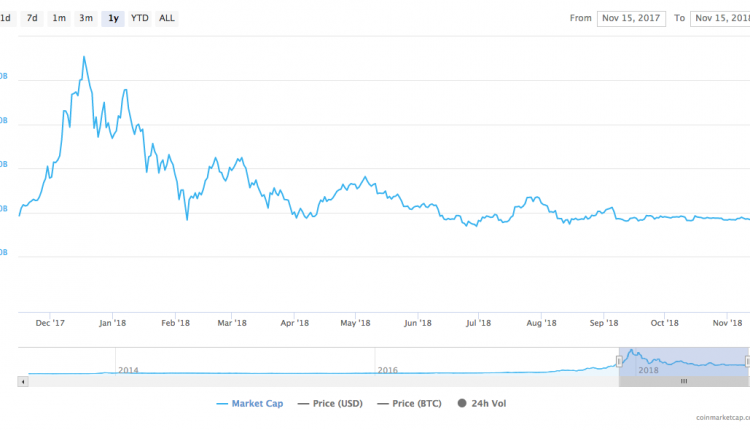

The researcher notes that the “realized capitalization” indicator ($ 80 billion) exceeds the value of the “network cost” indicator (Network value; $ 60 billion as of December 13). In essence, the latter is analogous to market capitalization and is calculated as the product of coins in circulation by their price.

The basis of the “realized capitalization” (Realized cap) is the aggregation of UTXO [exits of unspent transactions], taking into account the BTC price at the last coin activity. At the same time, the indicator does not take into account Bitcoins, which for a long time lie motionless and, probably, are lost forever.

The discrepancy between Realized cap and Network value, according to the researcher, suggests that the price of Bitcoin is likely to be fundamentally undervalued.

Rassi also analyzed historical data and came to the conclusion that a similar situation was observed during most of 2015, when the price was close to its bottom.

Bottom 's Traditional Network Value of 2015, while it tried to pick a bottom pic.twitter.com/uSQeBXsCOh

– Chris Russi (@chrisrussi) 14 December 201 p.

Recall previously known cryptanalyst Tom Lee expressed the opinion that the fair price of the first cryptocurrency is in the range of $ 13,800 – 14,800.

Subscribe to the BlockchainJournal channel on YouTube !

BlockchainJournal.news