Bitcoin (BTC) is still trying to find the bottom of the bear market on the anniversary of its record high price – $ 20,000.

At the time of publication, the world's largest cryptocurrency by market capitalization is trading at $ 3,286, which is 83.5 percent lower than the record high of $ 20,000 reached on December 17, 2017.

BTC also decreased by 76% since the beginning of the year (the price on January 1 was $ 13,880) and is about to complete its three-year series of victories.

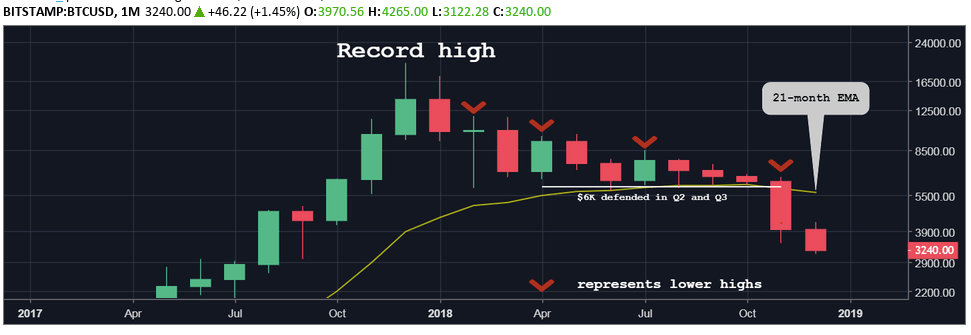

Reducing the BTC rate from $ 20,000 to $ 3,200 can be divided into the following steps:

- the price of BTC at the end of last year was $ 13,880, which is less by 44% compared with a maximum of $ 20,000.

- The effects of regulatory restrictions in China and South Korea have greatly affected the price. BTC at the beginning of the first quarter. Both nations were the biggest sources of demand for cryptocurrencies before the introduction of restrictions. Subsequently, prices fell to 7,000 dollars on March 31.

- Bitcoin spent most of the second quarter and the entire third quarter, defending the psychological level of $ 6,000. It is noteworthy that the key support level maintained its position in the third quarter, despite the decision of the US Securities and Exchange Commission (SEC) to reject Bitcoin-ETF. As a result, experts, including the billionaire Novograc, were convinced that the BTC had reached the bottom of about $ 6,000.

- The inability of BTC to achieve a significant price hike, despite repeated protection of $ 6,000, proved costly. November 14, prices fell below the critical 21-month EMA, signaling the resumption of sales from a record high of $ 20,000.

What awaits Bitcoin ahead?

BTC reached a 15-month low of $ 3,122 over the weekend and shows minor signs of life below the 21-month EMA. Short-term technical charts, however, signal a possible slight price recovery.

The above chart shows the BTC's path from record highs a year ago to the last 15-month lows around $ 3,100. The forecast will be bullish if and when BTC crosses the resistance of the 21-month EMA, this is currently a level of $ 5,719.

It is worth noting that today, the long positions of BTC / USD on Bitfinex rose to 35,773 BTC, this level was last observed on July 23. More importantly, long positions have grown by 33% over the past six days. This may be a sign that transactional hunters are paying attention to the extreme oversold conditions reported by the 14-week relative strength index (RSI).

Thus, the BTC may well show a corrective jump until the end of this year.

And what do you think about this? Leave your comments below!