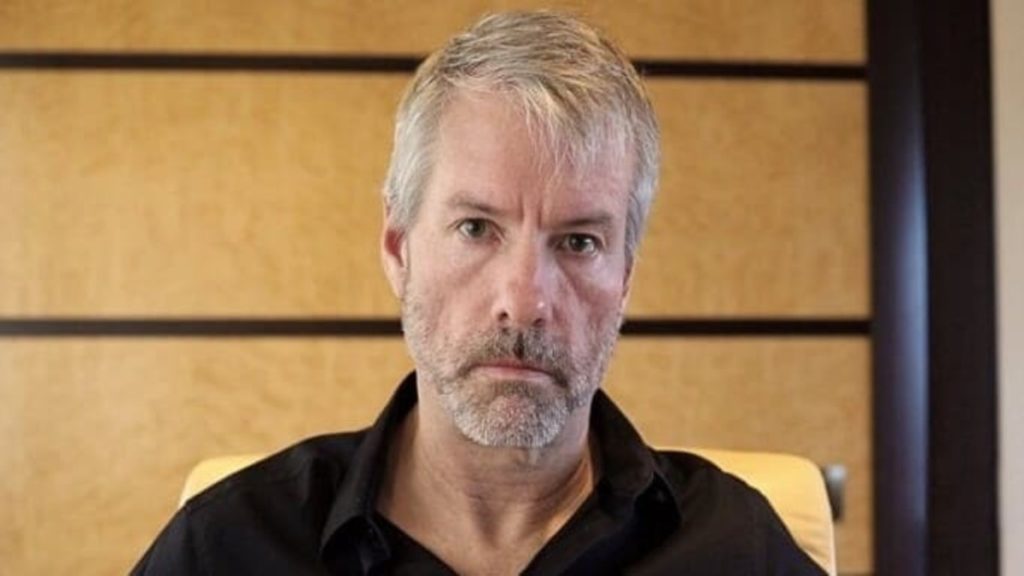

The gift of hindsight is priceless. Things might have turned out differently if MicroStrategy had invested in Ethereum instead of Bitcoin.

The Blockchain Center has produced a comparison page for MicroStrategy’s cryptocurrency assets. It took the firm’s Bitcoin purchases and projected what would have happened if they had been made with Ethereum.

The largest corporate holder of the assets at the moment is a software company, which controls 130,000 BTC. At current pricing, the investment made in August 2020 with a quarter-billion-dollar purchase is worth $2.63 billion.

Additionally, the company’s total cumulative investment losses were $1.34 billion. The comparison website claims that if it had purchased Ethereum instead, it would have made $1.47 billion more.

Ethereum Outperforming Bitcoin

MicroStrategy would currently possess 3.54 million ETH if it had filled up on ETH at the same time it did with BTC. Approximately $5.45 billion would be the value of this, which is more than twice the value of its Bitcoin holdings.

Earnings from staking are excluded from this. MicroStrategy would have made an additional 239,690 ETH worth almost $370 million, with ETH staking included.

Additionally, converting its BTC assets to ETH at this time would result in 1.7 million ETH. The corporation would make $132 million yearly (or around 4% APY) by staking this. “Holger,” the analyst who created the page, claimed that MicroStrategy had never experienced this level of operating income.

Three factors have led to Ethereum outperforming Bitcoin over the previous month: Its fundamentals are improving.

First, since it is now a proof-of-stake consensus, there is no selling pressure from miners. Second, the tracker indicates it is currently deflationary, with supply growth at -0.09% annually.

Thirdly, there has been a 99.9% decrease in network energy use. Due to this, the asset is far more enticing to organizations and corporations concerned about the environment, society, and governance.

ETH Price Analysis

According to CoinGecko, ETH has increased by 20.6% during the last two weeks. Comparatively, over the same 14 days, Bitcoin only managed 6.8%.

At the time of writing, the price of Ethereum is $1,549, unchanged from the previous day. Moreover, it is in a downtrend so far this month due to the exhaustion of the rally.

Along with the rest of the crypto market, Ethereum is still consolidating. In light of this, it is unlikely that the assets will have any immediate growth, but ETH may be at the forefront of the upward trend when the crypto winter ice does break.