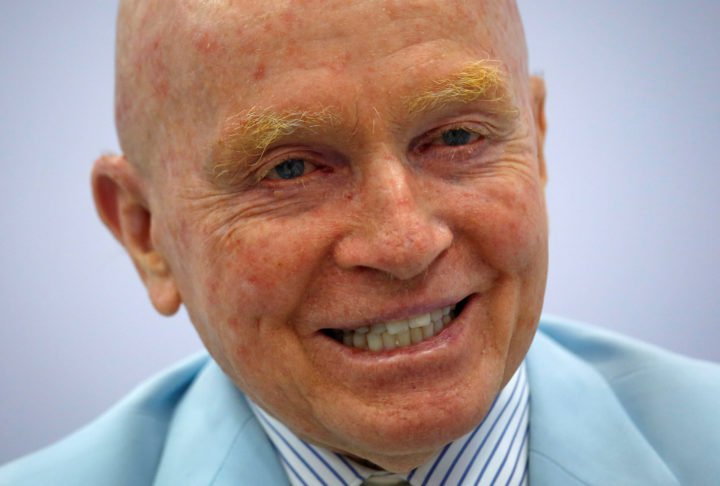

The growth in the rate of cryptocurrencies should increase the demand for real physical assets, in particular, for gold. This was in a conversation with Bloomberg, a well-known investor in emerging markets, founder of Mobius Capital Partners, Mark Mobius.

According to him, the long-term prospects of gold are growing amid weakening of the monetary policy of central banks.

“In an attempt to lower interest rates, central banks will print money like crazy. I think that you need to buy gold at any level, because its long-term prospect is up, up and once again up, ”Mobius said and invited investors to allocate about 10% of the portfolio for the purchase of bullions.

At the same time, he said that the most accurate definition of cryptocurrencies is “psycho-currencies”, since they are based on the faith of investors in the growth of this type of asset.

“I call these new currencies psycho-currencies because it is a matter of faith in bitcoin or another digital asset. And I think that with the growth in demand for cryptocurrency, the demand for real physical assets, including gold, will also grow, because it can play the role of not only an asset, but also a currency, ”added Mark Mobius.

In August 2019, gold reached a six-year high in response to a potential monetary easing by the Federal Reserve and other central banks due to the protracted trade war between the U.S. and China. Due to the fact that the US Treasury bond market signals a potential recession, investors are again turning to gold-backed stock exchanges.

It is noteworthy that the Mobius rhetoric regarding cryptocurrencies in recent years has noticeably softened. If in 2018 he called bitcoin “real fraud”, then in July 2019 Mobius said that despite a skepticism about cryptocurrencies, he would be “ forced to acquire bitcoin if its growth continues.”

Subscribe to BlockchainJournal news on Telegram: BlockchainJournal Feed – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news