According to JP Morgan, it is possible that the US dollar will go out of use, and this will contribute to the growth of bitcoin .

Gold analyst Jan Neuvenhus tweeted a report from one of the largest banks in the world, JP Morgan. It says that the dollar may "lose its value compared to a diversified basket of currencies that includes gold."

Bank analysts cite "a steadily growing deficit in the United States (both in the fiscal and in the trading sector)."

ICYMI from JP Morgan: 'we believe the US dollar could become vulnerable to a loss of value relative to a more diversified basket of currencies, including gold.'

JP recommends its clients to change their gold hodlings from 0 to 5% of their fx portfolio. https://t.co/tFDUCOR4fP pic.twitter.com/VeeKWHKu37

– Jan Nieuwenhuijs (@JanGold_) August 24, 2019

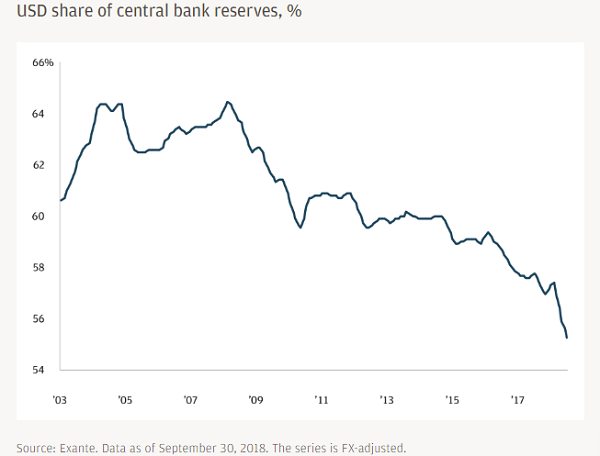

Numerous forecasts predict that over the next decade, the US budget deficit will reach $ 1 trillion. This can lead to a relative devaluation against the diversified basket, and can become a catalyst for the displacement of the US dollar from the position of the world reserve currency.

An unexpected report by JP Morgan echoes the comments of the head of the Bank of England Mark Carney, who said that the world needs a completely new financial system. According to him, the current one based on the US dollar is out of date. In fact, Carney suggests that the US dollar is currently playing a “destabilizing” role in the global economy, citing the effects of globalization and trade disagreements.

Since the dollar is the de facto reserve asset and the main calculation tool for international trade and central banks accumulating currency, "changes in the US economy affecting the dollar may have a serious side effect for the rest of the world."

The subsequent global system will be a boon to Bitcoin and gold. Former Goldman Sachs hedge fund sales head and current Real Vision CEO Raul Paul explained that the new infrastructure will almost certainly be digital, and will become the basis for the cryptocurrency market.

Publication date 08/28/2019

Share this material on social networks and leave your opinion in the comments below.