Cryptocurrency p2p platform Hodl Hodl announced on Wednesday, February 27, a new product called Predictions. Its launch is expected this spring, and according to representatives of the exchange, it can be a very useful tool for the Bitcoin ecosystem.

Introducing Predictions by Hodl Hodl https://t.co/403RFecdeM pic.twitter.com/InZfF3RJ63

– Hodl Hodl (@hodlhodl) February 27, 2019

The essence of the new product is to create a special market where you can enter into a contract with another user, payment for which depends on the outcome of a particular event. The simplest example is the creation of a contract, where one user claims that by May 2019 the price of Bitcoin will rise above $ 5000, and the other does not agree with this. The terms of the contract state that each party sends to the escrow address of 1 BTC, and in May the winner of the dispute receives 2 BTC.

In this case, the role of the "oracle" is played by a third party, which decides on the outcome of the dispute and rewards the winner. However, as representatives of Hodl Hodl say, they offer a more interesting scheme. So, the parties send funds to multisig (2 of 3) ekrow-address , and the oracle is distributed to a certain extent. Under an ideal scenario, both parties agree on the outcome of the contracts, since neither of them can unilaterally return those trapped in the escrow and, therefore, gains nothing by refusing the outcome of the bet. Losses are reputational within the framework of the platform and affect the future opportunities to create contracts.

“But even in the event of a dispute, Hodl Hodl leaves a chance to intervene with a third key, which can be used to sign a transaction in favor of the party who guessed the outcome. The best side of all this is that Hodl Hodl, as always, does not have access to the funds. Thus, our implementation of the prediction market can be called the peer-to-peer prediction market, ”the exchange said in a blog.

Contracts themselves are not limited to the price of Bitcoin and can be created for a variety of situations. For example, they may concern whether lenders will receive Mt. Gox your payouts in 2019. In this case, the lender who is awaiting compensation hedges the risks: even if he does not receive anything from Mt. Gox, he will win the argument.

Other examples of contracts may include election results, the price of oil or other assets, or even the weather forecast. The only condition that the exchange sets up and intends to moderate its observance is that the contracts do not contain anything illegal and cannot be interpreted in two ways.

Additionally, the exchange offers the possibility of creating contract coefficients and establishing minimum volumes. For example, in a contract with a ratio of 1 to 10, the contract creator sends 1 BTC to escrow, and the party that accepts it – 10 BTC. If the opposite party is not ready to send such an amount, and, for example, has only 5 BTC, then the contract creator sends 0.5 BTC.

“We believe that this will be an ideal and much-needed ecosystem tool. We especially want to point out that this is not gambling. Gambling, as a rule, is associated with the expectation of instant profit, quick execution and randomness. Prediction markets work differently – they focus on longer terms, financial planning and responsibility. And, of course, the Bitcoins themselves are stored on the escrow address, which is incomparable in terms of security with the storage of funds on centralized exchanges, ”added Hodl Hodl representatives.

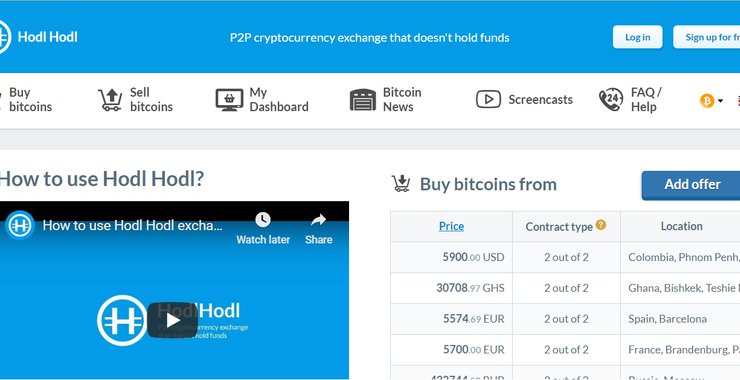

Recall that last November, Hodl Hodl, which also organizes the Bitcoin conference of the Baltic Honeybadger , launched a platform for over-the-counter trading . Its feature is the ability to operate with large volumes through non-custodial escrow addresses with a multi-signature.

Follow BlockchainJournal on Twitter !

BlockchainJournal.news

BlockchainJournal.news