Last week marked another milestone for digital asset investment products as they experienced capital inflows, extending the seven-week streak of inflows to over one billion dollars. Ethereum (ETH), in particular, managed to break free from the negative trend it was undergoing.

Throughout the week, total inflows amounted to $293 million, bringing the year-to-date total to $1.14 billion, positioning it as the third-highest year for capital inflows in history.

The consistent increase in assets under management (AUM) was evident, with a 9.6% rise in the last week and a remarkable 99% increase since the beginning of the year.

With a total AUM of $44.3 billion, this figure is the highest since the significant crypto fund failures in May 2022.

Ethereum Reverses Negative Trends

A notable phenomenon in the investment realm was the active participation of exchange-traded product (ETP) investors, constituting up to 19.5% of the total Bitcoin transactions on trusted exchanges.

This level of involvement indicates that ETP investors are playing a much more active role in this upturn compared to the years 2020 and 2021.

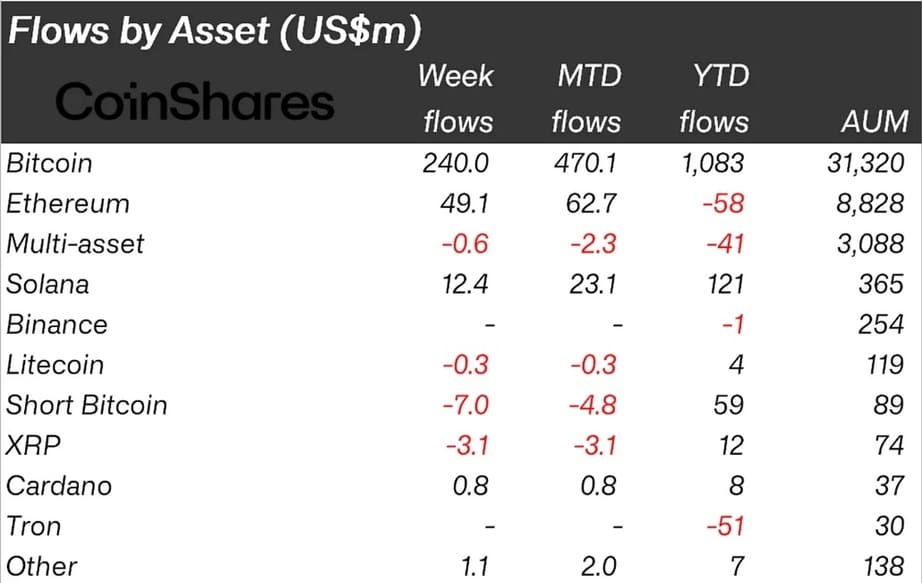

Regarding Bitcoin, inflows totaled $240 million last week, bringing the year-to-date total to $1.08 billion.

On the other hand, short Bitcoin positions experienced outflows of $7 million, signaling a continuing positive sentiment among investors.

Ethereum, on its part, saw its largest inflow since August 2022, reaching $49 million in the last week. While it is still far from reversing the $58 million outflow for the year, it is undoubtedly an interesting uptick and a potential turnaround heading into the close of 2023.

This shift in sentiment is likely related to the recent request for a spot-based Exchange-Traded Fund (ETF) listing in the United States.

Additionally, data reveals that Solana also attracted new inflows totaling $12 million.

Blockchain equity Exchange-Traded Funds (ETFs) saw inflows of $14 million, the highest since July 2022, bringing the year-to-date flows to a positive position of $11 million.