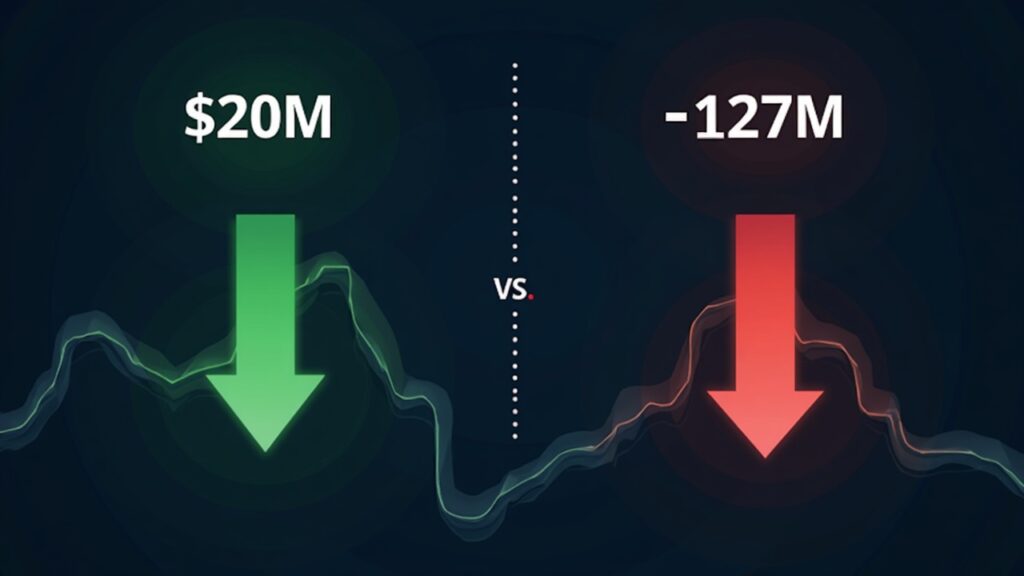

Cryptocurrency exchange-traded funds (ETFs) showed mixed behavior on October 23. Bitcoin ETF flows diverge from Ethereum significantly. Bitcoin attracted $20.33 million in net inflows. Meanwhile, Ethereum products recorded heavy outflows of $127.47 million. This data, reported by SoSoValue, emerges amid geopolitical tensions and anticipation of new U.S. inflation data.

The analysis of daily flows shows a clear winner. BlackRock’s IBIT led Bitcoin inflows with $107.78 million. However, Grayscale’s GBTC experienced a notable outflow of $60.49 million. Despite this, Bitcoin ETFs have accumulated weekly inflows of $355.76 million. In contrast, Ethereum’s situation is concerning. Fidelity’s FETH led the withdrawals with $77.04 million. This trend extends the losing streak for Ether funds, which already total $150.31 million in weekly outflows.

This divergence between the two main crypto assets is not coincidental. The market is reacting to growing macroeconomic uncertainty. Renewed trade tensions between the United States and China are a key factor. President Trump’s threats to impose tariffs of up to 155% on Chinese goods have shaken global financial markets. Additionally, investors are awaiting the upcoming U.S. CPI report. It is expected to show a rise in inflation, which complicates monetary policy decisions.

Is Ethereum losing its safe-haven appeal compared to Bitcoin?

The market’s reaction suggests a “rotation to safety.” Investors seem to perceive Bitcoin as a safer asset than Ethereum in times of stress. The global economy shows signs of volatility. Bitcoin remains stable near $111,300. On the other hand, Ethereum is trading around $3,957, accumulating a 6.5% drop for the month. This weakness where Bitcoin ETF flows diverge from Ethereum could put further pressure on ETH’s price in the short term.

The current data reflects a clear shift in investor sentiment. While Bitcoin consolidates its position, Ethereum faces a capital bleed in its ETFs. It will be crucial to watch if this outflow trend in Ethereum continues as long as global uncertainty persists. The upcoming inflation data and trade negotiations will be decisive. Some technical analysts note that Ethereum is testing key support in the $3,750 zone, which could suggest a possible rebound if it manages to hold.