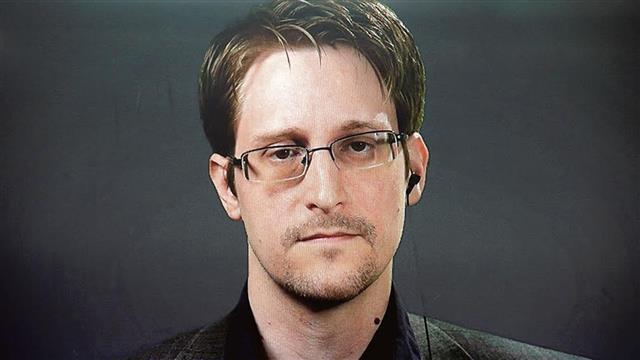

Edward Snowden, a former employee of the US National Security Agency, who several years ago told the whole world about total surveillance of citizens of different countries, outlined his thoughts on Bitcoin and blockchain technology.

“I really like Bitcoin’s fairness and fairness”

Snowden considers cryptocurrency transactions "impartial." This means that the process goes without the participation of large banks; only the parties to the transaction decide what to do with the money. For example, banks can make their own payments, and cryptocurrencies don't care who sends money to whom.

Digital currencies will be appreciated as long as "as long as there are people who want to transfer money without the participation of banks"

At a more fundamental level, cryptocurrencies (like gold and the dollar) are valued solely because people believe in their value. Snowden explains: "This belief is based on the ability of digital currencies to transfer incredible amounts of money around the world in electronic form, around the clock and without the participation of banks."

“Bitcoin has competitors”

Snowden points to Monero (XMR / USD) and Zcash (ZEC / USD) as potential alternatives. Their main advantage is the complete anonymity of transactions, which is enabled by default.

Bitcoin may not be fully anonymous, but this is the first really free money.

They can be translated to anyone, anywhere and for any reason. How bitcoin anonymous? Snowden believes that he is not anonymous, but simply unbiased and allows you to transfer funds around the world.

“If we don’t have anonymous transactions in five years, we’ll have to look for the reason for this in the laws and not in the technologies."

Fully protected coin technology is widely available and already in use. In other words, the only obstacle to its wider dissemination is the law.

“ Blockchain is just a fancy way of assigning timestamps”

Blockchain, the protocol underlying Bitcoin, is only a way of recording and guaranteed storage of information about events. The more blocks in the blockchain, the more difficult it is to make changes to past data.

“In the next few years, the speed of the blockchain will increase”

Snowden notes that currently Visa and MasterCard are much faster than Bitcoin, but this will change soon. Snowden explains: “In the next few years, blockchain bandwidth will increase to such an extent that it will no longer be considered a major problem.” For example, Nano is currently 300% faster than Ripple (XRP / USD).

“No more than 21 million bitcoins will be created”

What is the value of bitcoin? According to Snowden, at least part of his value is explained by the limited number of coins. At the moment, 17.4 million of 21 million bitcoins are in circulation. Snowden says: “The competition for the extraction of the remaining coins is so high that it requires the purchase of equipment and electricity worth hundreds of millions of dollars. Usually economists believe that these costs actually support Bitcoin and make up its intrinsic value. "

The main mistake of Satoshi Nakamoto was that he “did not provide for such success of Bitcoin”

Snowden describes it as a “flaw in all its glory”, implying an innovative mining process . Mining consumes huge amounts of electricity and emits more greenhouse gases than Switzerland, because every coin is very hard to get.

"Blockchains can be the tiny mechanism that allows us to create systems that do not need to be trusted."

Snowden is convinced that the blockchain is more than a buzzword: “You have learned the only thing that matters: the blockchains are boring, inefficient and uneconomical, but with the right settings, the information stored in them is almost impossible to fake. And in a world full of lies, the ability to prove something is truly a radical improvement. ”

The main cryptocurrency again updated the annual minimum after the next stage of the decline in the entire digital asset market. Over the past 24 hours, Bitcoin's market capitalization has decreased by 11.21%, and the price has set the 14-month low at $ 3368, according to data from CoinMarketCap and Bitfinex.