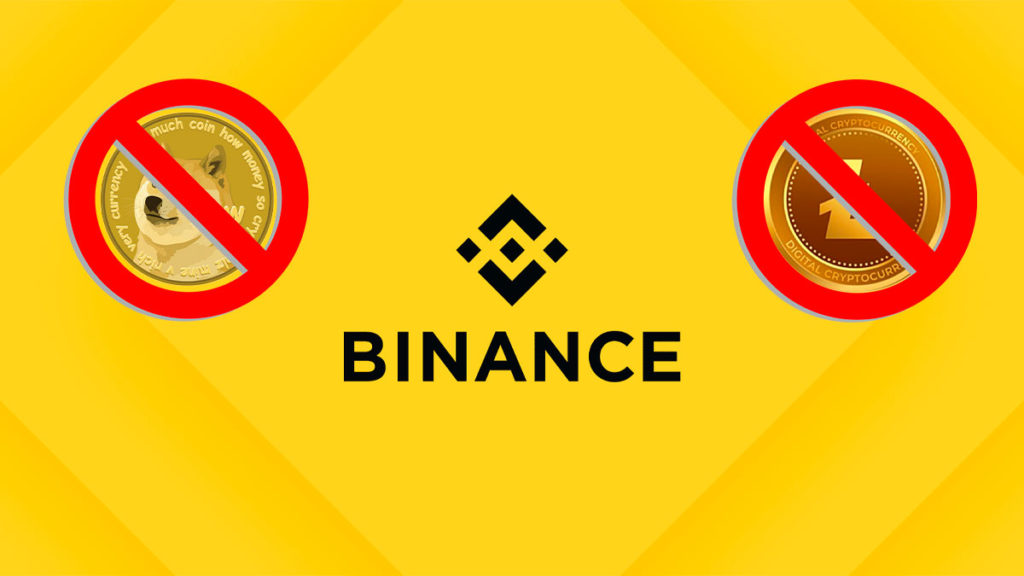

In a surprising turn of events, Binance, one of the largest cryptocurrency exchanges in the world, announced its intention to remove two trading pairs involving Litecoin (LTC) and Dogecoin (DOGE). These pairs, specifically perpetual futures linked to Binance’s own stablecoin Binance USD (BUSD), will no longer be available on the exchange.

Binance Continues It’s in House Cleaning

Users are advised to close any open positions before the scheduled delisting to prevent automatic settlement. Starting from August 24, 2023, at 08:30 (UTC), users will not be permitted to open new positions for the contracts in question.

Another aspect of this development is the decrease in the maximum leverage allowed for these instruments. In the period leading up to the delisting, the leverage for these pairs will be reduced by half, with a maximum of 10x. This change will also affect investors who had open positions before the announcement was made.

This action is the most recent in a series of similar measures taken by Binance. The crypto giant, known for its black and yellow branding, has been actively engaged in what could be described as a general cleanup, with a particular focus on tokens directly linked to its native stablecoin, Binance USD (BUSD).

Additionally, instruments associated with tokens facing regulatory challenges, such as Cardano (ADA), have also been subject to reductions.

This cleanup by Binance may be attributed to the increased scrutiny the exchange is currently facing from regulatory bodies, including the U.S. Department of Justice (DoJ) and the SEC. Binance has been the subject of several high-profile investigations this year, marking a challenging period for the platform.

In its most recent development, Binance filed a motion with the court seeking a protective order from the SEC, requesting that the SEC be prohibited from questioning witnesses on matters outside the scope of the case. As a result, Binance’s motion was referred to a judge.