Large-scale investors, also known as whales, use the current bear market to accumulate a huge amount of Ethereum (ETH).

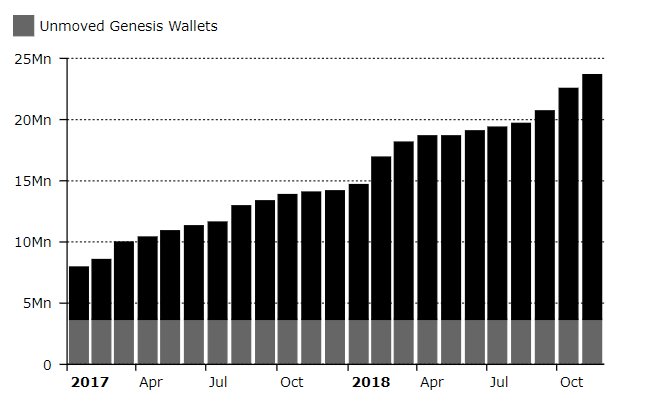

According to a recent report by the Diar research group on the cryptocurrency market, in 2018 more ETHs were accumulated at the whales' addresses than in any other period of time. During the eleven months of this year, almost 10 million ETH were accumulated, as a result, the total cost of the top 500 addresses was about 20 million ETH (about 2.3 billion US dollars) – just under 20% of the total turnover offer.

This period of accumulation starts from the moment when the price of ETH has dropped from about $ 800 to $ 111. Ethereum also recently lost 2nd place in the ALT100 rating in terms of market capitalization, losing that position to Ripple (XRP).

The research team Diar believes that the growth in ETH holdings was mainly due to the fact that small investors left the position of ERC-20 markers, as they massively suffered losses in 2018. While the net inflow this year was positive – $ 1 billion, it is important to note that 90% of these funds came in the first quarter.

Leave your comments below!