Leading cryptocurrency exchange, Coinbase, just issued a statement to commit to a series of policies that will enhance user experience by providing a fair and efficient marketplace for digital asset trading.

According to the official blog post, Coinbase will list only those assets that would meet the requisite legal and cybersecurity standards, allowing customers to gather as much information as possible to make educated investment decisions. They plan to lay down a clear demarcation of digital assets allowing users to choose from Coinbase-held and Coinbase-backed assets. The list of cryptocurrencies listed the exchange will be kept completely independent and hold critical information as to how these assets come up on the company’s corporate balance sheet.

Marketplace Defined By Users

As per the report, Coinbase’s aims to provide a “fair and efficient marketplace where the participants decide”. The policies will include on asset listing, employee trading, investor trading as well as corporate balance sheet holdings.

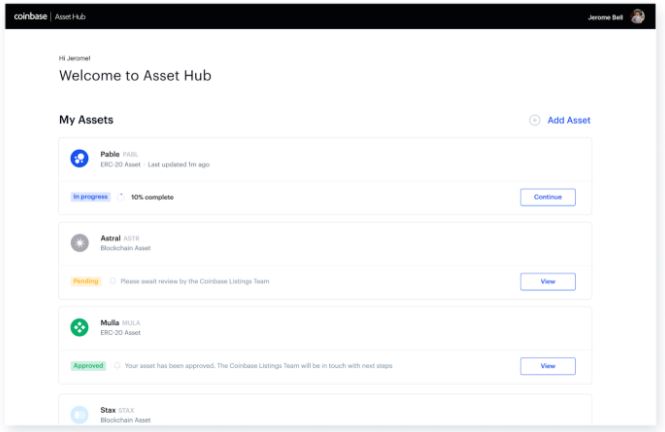

The asset listing process will be done by a special committee called the Digital Asset Listing Group, documenting formal policies, which will be subjected to reviews and approvals by the regulators. The Digital Asset Listing Group will vote on what assets can be listed by a review process that will evaluate assets based on the compliance, legal, and information security concerns. The majority of assets are submitted directly by the asset issuers through the Asset Hub portal. It is worth nothing that the voting group will not include Coinbase CEO Brian Armstrong or any other Coinbase Global Board members who has vested financial interests.

The leading crypto exchange plans to lay down stricter rules restricting all employees from trading the tokens it is considering for listing to make sure no one at Coinbase is front running assets, even if they don’t work on our asset listings team.

The report also states that the organization’s Ventures and Listings teams will be operating completely independently of each other, with no overlap in shared information. The process wont even allow ventures capital firms to review on the particular asset under review. The trading platform said,

“We have no control over or proprietary visibility into the plans of early token backers (VCs, founding team, etc.) on their selling activities. Because trading typically occurs across many exchanges (not just Coinbase), and because large holders and even asset issuers are often unknown, we do not have the ability to play a role in any lock-up type mechanisms.”

Business Expansion

Last year the cryptocurrency exchange had launched a simple, streamlined product for issuers to list their assets dubbed as Coinbase Asset Hub. Asset Hub will streamline the asset listing process today, and expand the number of services offered to digital asset issuers in the months to come. The goal is a single interface at Coinbase for digital asset issuers to manage their assets.