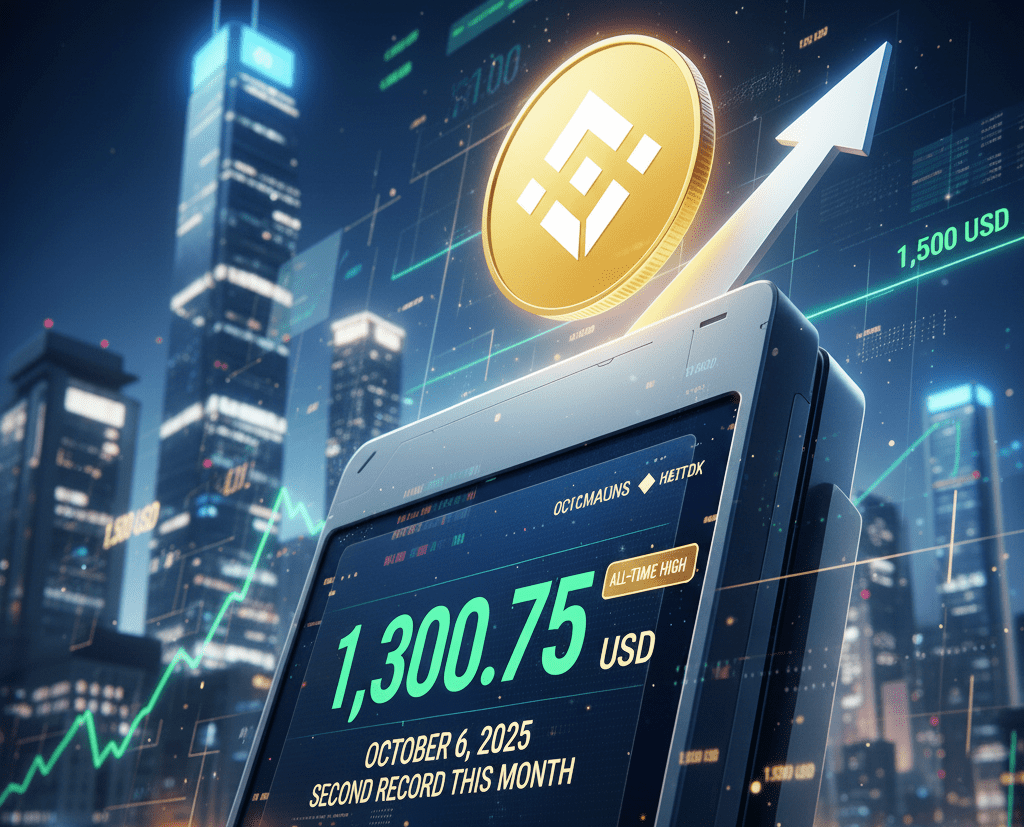

BNB, the native cryptocurrency of Binance, has shown exceptional performance this October 6, 2025. Its price soared past the $1,300 barrier. This event marks the second such record in less than a month, solidifying its market position. Technical analysis, such as that provided by analyst Crypto King, suggests an optimistic outlook.

The upward momentum has allowed the digital asset to position itself firmly. BNB became the third-largest cryptocurrency by market capitalization, surpassing direct competitors like XRP. Figures from portals like CoinGecko show its market valuation now exceeds $154 billion, a significant milestone for its investors and the ecosystem at large.

What Key Factors Are Driving This Growth?

This impressive rally is not an isolated event. It is part of a broader, favorable market context. Bitcoin’s recent all-time high, which surpassed $126,000, has generated a positive spillover effect. Furthermore, the increase in institutional inflows reflects growing confidence in digital assets as a reliable store of value. Another determining factor is that 30% of the total BNB supply is currently staked, which reduces circulating supply and can contribute to upward pressure on the price.

The relevance of this milestone is magnified when considering the historical context. October has traditionally been a month of good returns for the sector. This seasonal pattern, combined with the project’s solid fundamentals, creates a favorable scenario. The advance represents a key consolidation for the digital economy. Therefore, investors are closely watching its evolution.

What is the Next Target for the Price?

Analysis of price charts reveals very interesting technical patterns. A breakout has been identified that could anticipate further gains. According to projections based on previous breakouts, which yielded returns of 27% and 29%, the next potential target is $1,500. This scenario would imply an additional 51% rise, a prospect that excites holders of the asset.

Despite the general optimism, it is important to consider other scenarios. More conservative analysts suggest that a consolidation phase between $1,200 and $1,350 is likely. The market needs to digest the recent gains before seeking new highs. Likewise, if profit-taking accelerates, a correction towards the $1,100 support is not out of the question, a level that would serve as a new entry point for many.

The current situation for BNB is a reflection of the strength and maturity the crypto market is reaching. Its ability to set two all-time highs in a single month demonstrates sustained interest from the investment community. The asset’s next moves will depend on both Bitcoin’s evolution and its own ability to maintain bullish momentum, with an eye on breaking through new psychological barriers.