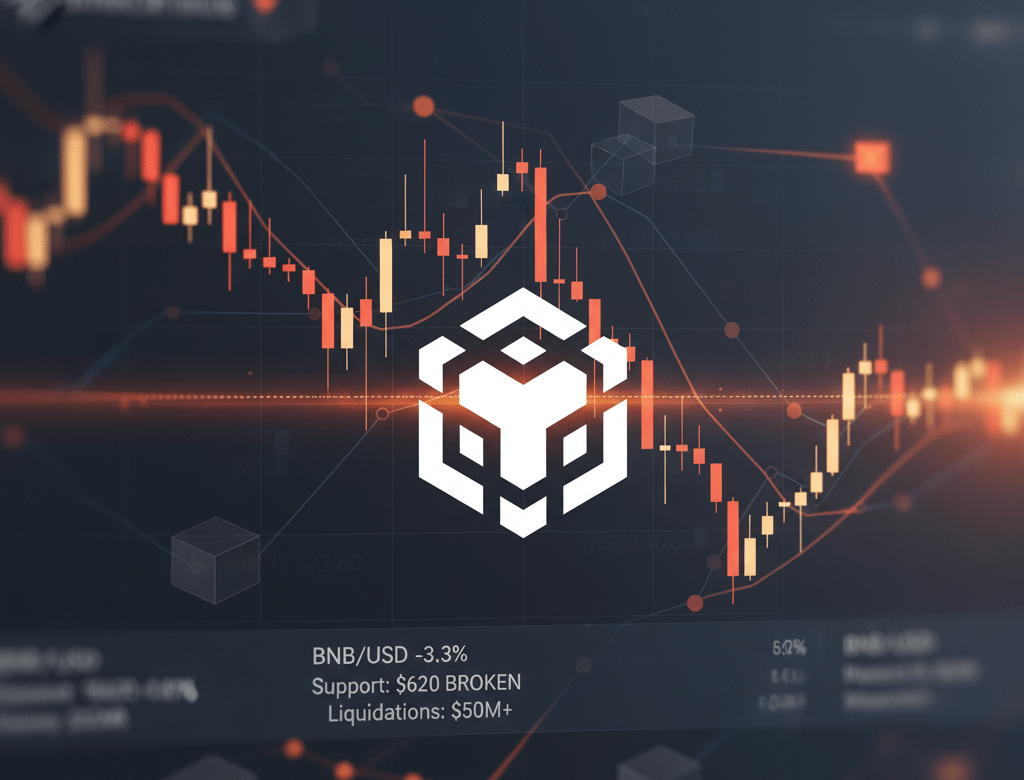

BNB, Binance’s native token, registered a sharp decline of 3.3% this Tuesday, October 21. The BNB price drop occurs amidst a widespread market correction. Technical analysts, like Alex Thorne of ByteTree Research, note that selling volume intensified sharply.

The asset’s price broke the crucial support level located at $620. This movement triggered automated liquidations on various platforms. Futures data shows a significant increase in open interest. However, spot trading volume soared, confirming the sellers’ urgency to exit their positions. The cryptocurrency reached an intraday low of $610 before stabilizing.

This correction is not isolated. It occurs after weeks of high volatility in global markets. Macroeconomic uncertainty seems to be affecting risk assets. BNB had held the $620 support for the last quarter. Its breach is seen as a short-term bearish indicator by the community. The underlying blockchain technology remains robust, but investor sentiment is fragile.

Is this the final capitulation or the start of a bearish trend?

For BNB investors, this situation creates nervousness. The loss of technical support opens the door for further tests at lower levels. The next psychological floor is located near $600. Analysts are watching if buyers will show interest at these lower prices. The market’s reaction in the next 48 hours will be vital.

The crypto market is showing a “shakeout” phase. The heavy selling of BNB highlights the sector’s current weakness. Traders are now closely monitoring inflation data. These factors will determine the market’s direction in the final quarter of 2025. Recovery will depend on overall confidence.