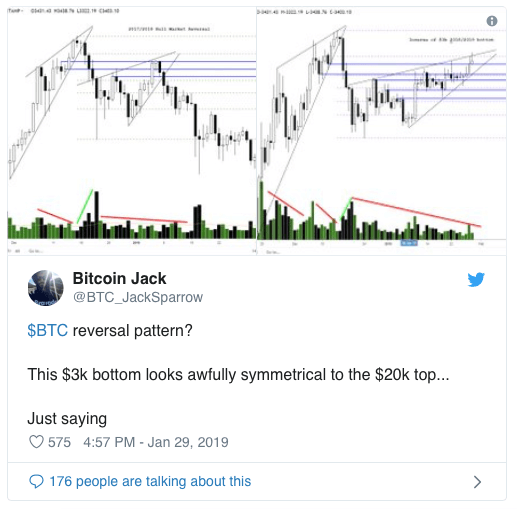

A well-known trader under the nickname Jack “Sparrow” (Jack Sparrow), recently wrote on Twitter about his analysis, which may indicate that the cryptocurrency market is approaching the bottom. Jack noted that the current inverted BTC schedule resembles a schedule that was at a record high of $ 20,000 set at the end of December 2017.

Although the trader did not claim that the # 1 cryptocurrency finally hit the bottom of exactly $ 3,000, he combined two charts to show the similarities. Based on Jack’s analysis, BTC may begin to show signs of life in the coming months.

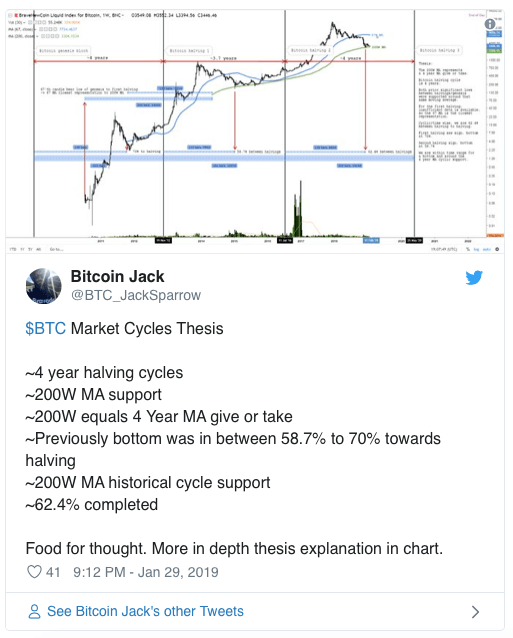

In another optimistic tweet, Jack set out a thesis about BTC's long-term market cycles. The trader noted that there is a pseudo-inevitability of Bitcoin's long-term price action.

In the previous bear markets, which were previously divided in half, BTC has reached the bottom between 58.7% and 70% of the path to emission reduction. Right now, BTC has overcome 62.4% of the way to the next reduction (in time). And if the story is an indicator, it means that the asset can finally find a long-term low in the coming months, if not weeks.

But it is worth noting that Vinni Lingham, who is the co-founder and CEO of Civic, has a less optimistic attitude towards the growth of BTC. In an interview, Lingham said that “the cost of Bitcoin is likely to fall to a significant level of $ 3,000,” and if the cryptocurrency price is below this level, then the current “crypto-winter” will become a “crypto-nuclear winter."

The head of Civic is not the only one who doubts that BTC can currently rise higher. For example, Charles Hayter, co-founder of CryptoCompare, noted that there are currently no catalysts for asset growth.

And what do you think about this? Will the BTC recover soon?