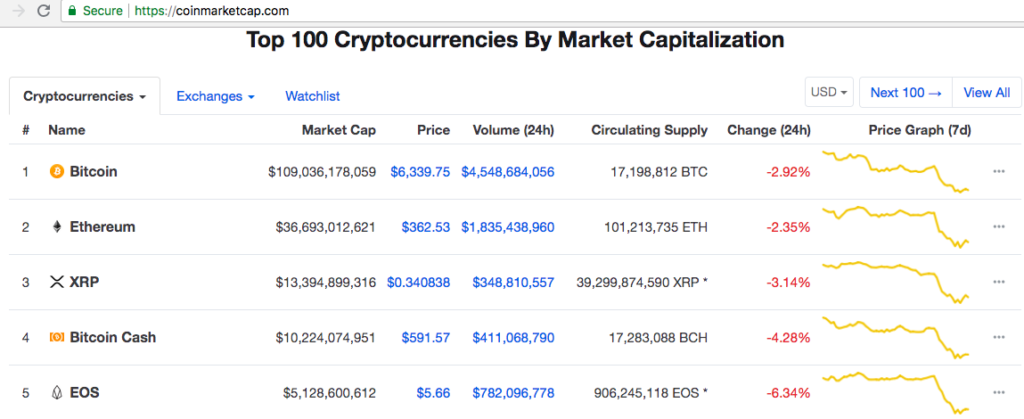

The current situation on the cryptocurrency market can be described as a continuing correction. The short-term outlook of the crypto market is seen in achieving the goals of a local decline, with a consequent rise to the upper limits of the current correctional corridors. The market may be waiting for some kind of external incentives or catalysts that will help cryptocurrency out of consolidation.

A further RoboForex analyst Dmitry Gurkovsky will tell about further possible scenarios for the price movement of several popular altcoins.

Bitcoin Cash

The technical picture of Bitcoin Cash on the hourly timeframe demonstrates the continuation of the development of a downtrend. After the formation of convergence on the MACD indicator, the growth momentum of quotes was able to test the resistance of the current channel of decline.

After rebounding from the line of resistance, the next reduction impulse can be directed to reaching support at $ 478. The development of such a scenario is the Black Cross signal on MACD.

The main resistance to the current dynamics is the level of $ 525. Its breakdown will allow quotes to rise to levels of $ 550.50 and 565. As confirming factors for the development of upward dynamics will be not only the approach and test of the 525 mark, but also the Golden Cross on Stochastic in the oversold zone.

EOS

From the point of view of technical analysis, the current EOS dynamics on the hourly timeframe demonstrates the presence of an upward trend. At the same time in the short-term scale quotes are reduced to the line of support of the upward channel. The purpose of the decline is the $ 5.77 mark, the breakdown of which will open the way for the quotes to go down to the lower projection channel to the $ 5.62 mark.

In the case of overcoming the level of $ 5.62, we can expect a decline to $ 5.50, and then – the development of a new growth impulse. In turn, the MACD indicator formed the “Black Cross”, the Stochastic indicator went out of the overbought zone, which may be an indirect confirmation of the development of a downward trend in the coming week.

Eliminate the possibility of breakdown of the resistance line in the $ 5.95 mark is also impossible. Its breakdown will be a signal for further growth to the level of $ 6.18.

Ethereum

On the Ethereum hourly chart, we can see the overcoming of the support line for the short-term growth channel. Growth trend was a correction within the downtrend. The breakdown of support was accompanied by the formation of “Black Crosses” on Stochastic and MACD, which may be an additional confirmation of the development of a downtrend.

As its goal it is worth considering the support line and the level of $ 205. But the achievement of this goal will be possible only after the breakdown of the local support level at $ 220.10. In the event of a breakdown of local resistance in the $ 230.40 mark, the growth impulse may reach $ 238.35.

Litecoin

To date, the four-hour chart Litecoin demonstrates the consolidation of cryptocurrency quotes in the lower projection corridor. The current dynamics can be described as “sideways”. At the same time, the market forms a downward channel.

The main local goal of the decline is the support line of the projection corridor – a mark of $ 53.15. This goal can be achieved after the breakdown of the level of support for the “outset” at $ 56.30. Confirming factors in favor of the development of decline are the transition of MACD lines to the negative area, “Black Cross” and the departure of Stochastic to the oversold zone.

Ripple

Ripple on the hourly chart shows the period of correction in the form of "outset". But at the same time, the cryptocurrency is in a downward trend. Overcoming the lower limit of the "outset" will allow quotes to reach the support line of the medium-term correction channel – the level of $ 0.414.

The next reduction impulse, reaching the target area and stochastic entry into the oversold zone will allow to form a convergence as a turn signal. The main confirmation of the trend will be the breakdown of resistance at the mark of $ 0.471, and the growth target will be the level of $ 0.60.

Attention!

Forecasts of financial markets are the private opinion of their authors. Current analysis is not a guide to trading. RoboForex is not responsible for the results of work that may occur when using trading recommendations from the submitted reviews.

Subscribe to BlockchainJournal news on VK !

BlockchainJournal.news