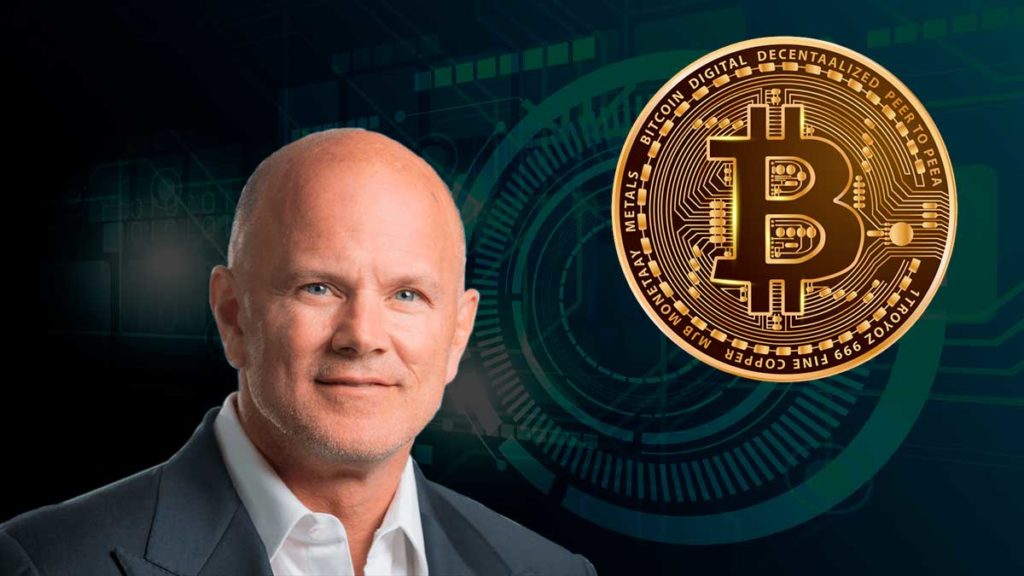

Mike Novogratz, the founder and CEO of Galaxy Digital, a leading cryptocurrency investment firm, has predicted that 2024 will be a year of institutional adoption of Bitcoin, driven by the approval of spot Bitcoin exchange-traded funds (ETFs).

In a conference call with investors on Nov. 9, Novogratz said that he expects the US Securities and Exchange Commission (SEC) to approve several spot Bitcoin ETFs by the end of 2023, which will be followed by an Ethereum ETF. He said that these products will provide a “seal of approval” for Bitcoin and other cryptocurrencies, and attract more institutional investors to the space.

2024 Could Be Bitcoin’s Biggest Year Yet

Novogratz predicts that the year 2024 will mark a significant increase in institutional adoption of cryptocurrencies, primarily initiated by the Bitcoin ETF, followed by an Ethereum ETF. As these institutions gain confidence and the government endorses Bitcoin, it is anticipated that other allocators will begin to explore opportunities beyond Bitcoin. This is expected to result in an influx of capital into the cryptocurrency market.

Novogratz added that institutional investment could peak in 2025, as more innovations in tokenization and wallets emerge. He also stressed the importance of having a dollar-backed stablecoin that reflects the values of the US and is widely adopted around the world.

Galaxy Digital is one of the many firms that have filed applications for spot Bitcoin ETFs with the SEC, in partnership with Invesco. However, the SEC has not approved any spot Bitcoin ETFs yet and has only allowed ETFs that track Bitcoin futures contracts, which have lower liquidity and higher fees than spot products.

Novogratz said that he believes the SEC will eventually approve spot Bitcoin ETFs, as the demand and the market maturity increase. He said that a spot Bitcoin ETF will bring more capital and life into the crypto ecosystem, and enable more innovation and growth.

“This ETF is giving us all breathing space, putting life in the system. That brings in capital that allows the rest of the stuff to flourish. But I think if you look at the crypto long-term plan, it’s on target,” he said.