In early August, US President Donald Trump again tweeted that he would increase duties on Chinese goods, and the price of Bitcoin instantly rose by $ 400.

Trump announced that it will be duties on goods worth $ 300 billion, and they will be introduced from September 1, 2019. The duty will affect all goods from China.

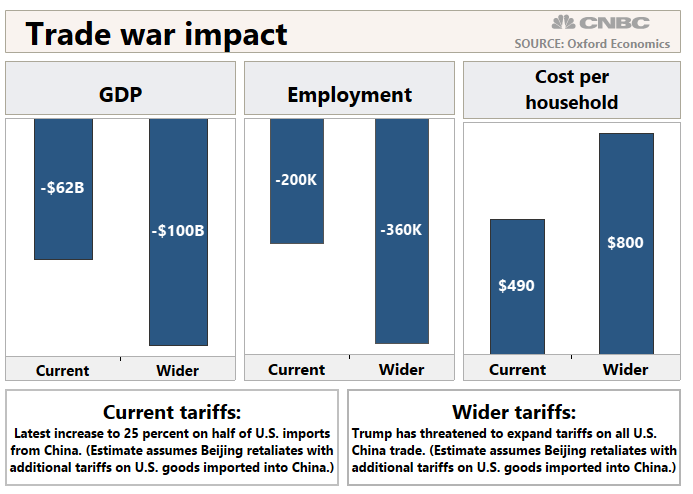

However, the news, which is negative for consumers, is becoming positive for the price of Bitcoin. The proposed duty allegedly is just a “small tax”, and Trump threatens to increase it by 25% during a trade war.

… buy agricultural products. In addition, many people continue to die! Trade talks are continuing, and …

– Donald J. Trump (@realDonaldTrump) August 1, 2019

“China recently agreed to buy more agricultural products in the United States, but did not. In addition, my friend President Xi said that he would stop selling fentanyl to the United States, but that did not happen, and many Americans continue to die! ”

In early May, just a week after the introduction of the 25% tariff for Chinese goods, Bitcoin jumped 40%. IEF from BitFinex for $ 1 billion and positive sentiment at the Consensus cryptocurrency conference in New York were other factors behind the rise in Bitcoin prices.

China's influence on bitcoin

Chinese investors are forbidden to trade and own Bitcoins. However, they can buy Bitcoins using OTC VPN-services on different kriptobirzhah or can trade on p2p-platforms.

Despite China’s ban, many believe that Chinese around the world have contributed to the recent rise in Bitcoin prices by hedging their money against the falling yuan. The Chinese state news agency Xinhua called Bitcoin " safe haven ".

Not only Chinese investors, but also stockholders are trying to find alternative investments for themselves. As noted by the South China Morning Post, in 2019, gold and “digital gold”, which helped them to hedge their assets, were popular among such investors.

Publication date 08/03/2019

Share this material on social networks and leave your opinion in the comments below.