Paris opened the door to investing in digital assets. Analysts continue to analyze the law that the French National Assembly passed on April 11. As the local newspaper Les Echos writes about this, the point is that the country's insurance companies now have the opportunity to issue “cryptocurrency-based insurance products”.

What does this mean?

As Emilien Bernard-Elzias, a lawyer at Simmons & Simmons LLP explains:

“It is obvious that through participation in special professional funds (SPF) such organizations are able to directly invest in cryptocurrency.”

Indeed, such investments are spelled out in the law and they suggest that funds for investments in digital assets can be obtained through the sale of life insurance policies. An amendment has also been made to Article 26 of the French Code of Cash and World Trade, which introduces the concept of a digital asset.

The law received significant support from senators: according to Reuters:

- 147 voted for,

- “Against” – only 50.

It is noteworthy that the adopted document does not provide for any restrictions on the volume of investments of insurance organizations in cryptocurrency. Although the most discussed option of SPF, Bitcoin ETF , has not yet received a start in life, however, analogues of such tools have begun to appear in the world, particularly in Sweden and in Singapore. Considering the possibilities of electronic commerce, French insurers also have access to them.

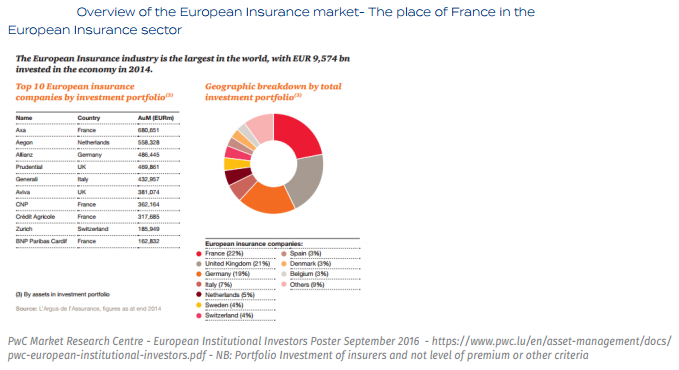

The document that emerged was an initiative of supporters of the current president of France, Emmanuel Macron, from his party La République En Marche. The current owner of the Elysée Palace recently pays great attention to new financial technologies. This time it is a question that companies whose total assets exceed 1.77 trillion euros have gained access to the cryptocurrency market.

Publication date 15/04/2019

Share this material on social networks and leave your opinion in the comments below.