On-chain analytics and market reports from early January 2026 showed Cardano (ADA) losing momentum after failing to clear key resistance, as shifts in holder behaviour eroded the case for a near-term 50% rally. T

Data indicated a sharp change in distribution patterns. The 365‑day to two‑year cohort increased transaction volume by roughly 135%, rising from about 1.92 million ADA to 4.51 million ADA on that date. That surge implied profit taking or repositioning by long-term holders, which removed a layer of stable buying pressure.

At the same time, the 30‑ to 60‑day cohort drastically cut selling activity. Spent coins in that short‑term group fell by nearly 92%, from approximately 55.42 million ADA to 4.28 million ADA. Market analysts interpreted this as speculative buyers stepping in to absorb supply rather than a return of conviction among deep holders, creating fragile support that could unwind quickly if sentiment tipped.

Technically, ADA had been compressing inside falling‑wedge and symmetrical‑triangle structures. The wedge dated back to early November and price had defended the $0.383 support zone. These patterns usually hint at a directional move, but buyers repeatedly failed to overcome layered overhead resistance.

Technical constraints and macro cross‑winds

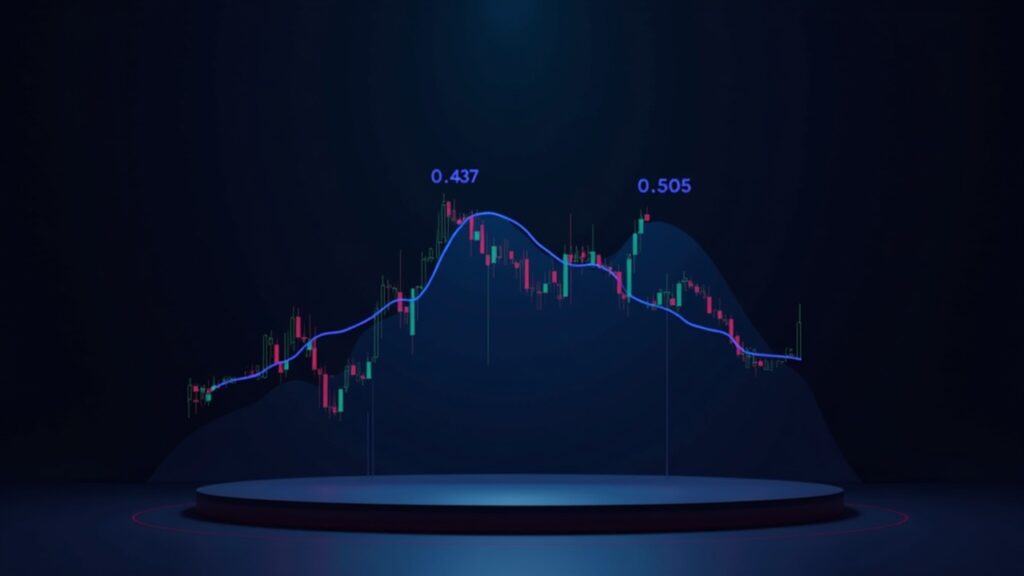

A decisive close above $0.437 — aligned with the 100‑day EMA — was identified as the trigger required to validate the bullish wedge and open a potential ~49% move toward $0.505. Until that close occurred, the lack of conviction from buyers left upward targets speculative and vulnerable to rejection.

Cumulative long liquidation leverage stood near $26.66 million, roughly 89% higher than short liquidation leverage at $14.11 million, amplifying the potential for cascading liquidations should prices slip. Open interest in ADA futures had also softened, signalling caution among traders.

eports cited recent tensions in South America — including the U.S. capture of Venezuelan President Maduro — that contributed to a risk‑off tone, a firmer U.S. dollar and reduced appetite for risk assets. That environment capped upside even where chart setups appeared constructive.

nvestors are now watching whether buyers can engineer a sustained close above $0.437; such a move would materially improve the odds of a larger advance toward roughly $0.505.