Bitcoin fell to its lowest point in more than a week as a result of investor uncertainty in the wake of a potential Federal Reserve interest rate hike and increased regulatory scrutiny of the cryptocurrency industry.

Crypto Market Falls, The US Regulatory Scrutiny Increases

As of 2:53 a.m. in New York, the largest token had fallen as much as 6.5 percent on Tuesday and was trading at about $20,904. The recent high fliers, Polygon and Ether, were down about 10%, while the MVIS CryptoCompare Digital Assets 100 gauge lost more than 5%.

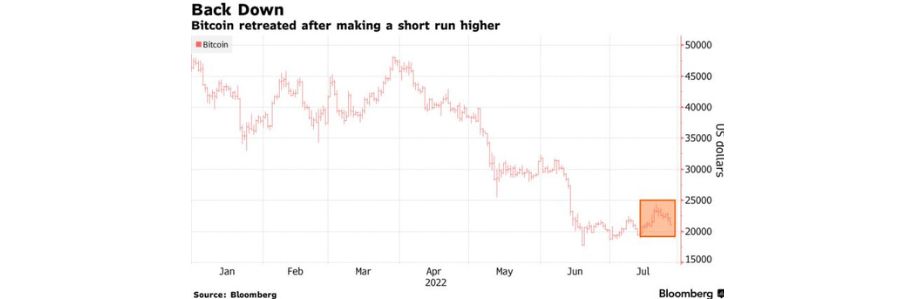

The decline has dampened hopes for a long-lasting Bitcoin recovery and brought the cryptocurrency back to a trading range between $19,000 and $22,000. Risk appetite typically declines before the anticipated 75 basis-point Fed rate increase on Wednesday as a result of the tightening cycle that is robbing liquidity.

According to Katie Stockton, co-founder of Fairlead Strategies, “We’ve got some stabilization over the past several weeks and that gave some folks optimism that perhaps a bottom was being put in place.” We are not persuaded.

Digital currencies have taken a beating this year due to rising interest rates and well-publicized collapses like that of the cryptocurrency hedge fund Three Arrows Capital. Since 2022 began, the price of bitcoin has decreased by 55%.

“Macro drivers haven’t flipped for people to really go long, and bear market squeezes are always very vicious,” said Patrick Chu, head of institutional coverage of APAC at OTC trading platform Paradigm.

The turmoil is leading to ever greater regulatory oversight of the industry

According to those with knowledge of the situation, Coinbase Global Inc. is being investigated by the US to see whether it inappropriately permitted Americans to trade digital assets that ought to have been registered as securities. Shares of Coinbase dropped by as much as 20%.

According to The New York Times, which cited people familiar with the situation, the Treasury Department is looking into rival exchange Kraken in regards to whether it permits users from Iran to trade on the site.

Geopolitical unrest, with Russia reducing gas supplies to Europe and rising food prices raising worries about instability in developing economies, adds to the uncertainty regarding the path of crypto assets. This year, the US dollar is at a disadvantage to all other significant developed-market currencies, which is another obstacle for digital tokens.