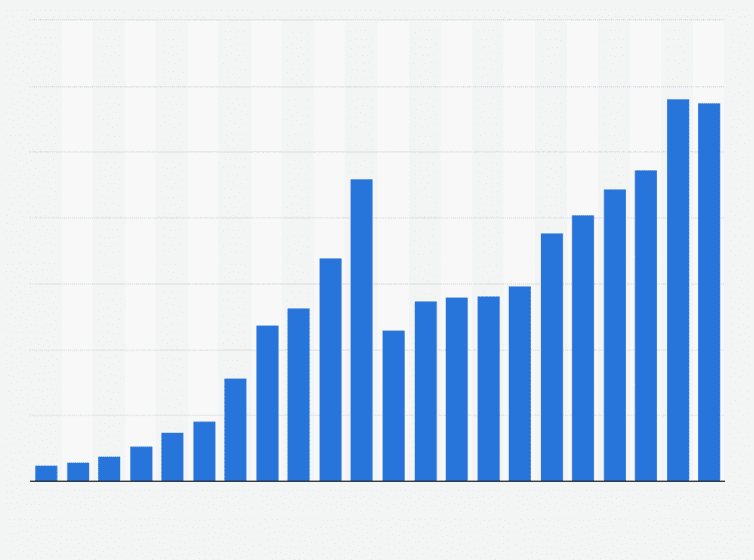

The value of assets under management of Grayscale Investments for the first time reached $ 2.7 billion, according to a report for the second quarter.

As the largest digital currency asset manager, our report has been emerged as an industry benchmark for investment sentiment. What are the trends of the first half of 2019? Check out our Q2 Digital Asset Investment Report: https://t.co/PWFQ1kJrKr pic.twitter.com/ekkfBgOM1u

– Grayscale (@GrayscaleInvest) July 16, 2019

Thus, the value of assets under management of the company increased almost three times in comparison with the figures for the first quarter.

Note that this development has provided not only the growth of the price of Bitcoin and other cryptocurrencies, but also the influx of new investments. In particular, in the second quarter, Grayscale Investments managed to raise $ 84.8 million for products.

It is noteworthy that while the main investment fund Grayscale Bitcoin Trust was temporarily closed for new investments in May and June. The remaining funds accounted for 24% of investments, although in the first quarter this figure did not exceed 1%. Investors show the greatest interest in the Grayscale Ethereum Trust and the Grayscale Ethereum Classic Trust.

It is worth adding that the institutional audience remains the main audience of the company, however, offshore funds managed to overtake American investors.

In addition, Grayscale recorded investment performance for all ten instruments for the first time.

Recall that in May, the head of the Digital Currency Group, Barry Silbert, reported that the cost of cryptocurrencies managed by Grayscale Investments exceeded $ 2 billion.

Subscribe to the BlockchainJournal news in Telegram: BlockchainJournal Live – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news