The cryptocurrency platform Bakkt acquired the developer of custodial solutions DACC for $ 11 million. This follows from the analysis of the financial report of the parent company Intercontinental Exchange (ICE) for the second quarter, reports The Block .

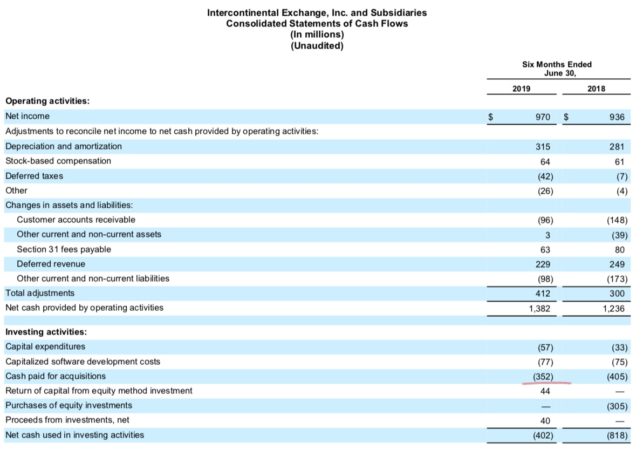

Thus, on the eighth page of the document, the amount that ICE spent on purchases of other companies over the course of six months is $ 352 million. However, the report said that the acquisition of Simplifie LC in June cost the corporation $ 338 million. the moment kept another $ 16 million, so the actual value of the transaction was $ 322 million.

10q 1q19 Amended by BlockchainJournal on Scribd

Then, the report says that Bakkt acquired two companies: talking about some of the valuable assets of the broker Rosenthal Collins Group (RCG) and the DACC itself. If you examine the ICE report for the first quarter, you may find that the deal with RCG most likely cost $ 19 million. Such conclusions follow from the fact that for a specified period of time the corporation no longer made any public purchases.

Thus, a $ 11 million deal with DACC can be estimated. Thus, during the corporate call, in the first quarter, ICE CEO Jeff Sprecher stressed that cryptozyme made this purchase available, because otherwise the capitalization of DACC would be out of tune.

Recall that at the end of 2018 Bakkt closed a round of financing for $ 182.5 million, which included Microsoft, Naspers, Galaxy Digital, Boston Consulting Group and others. It is believed that after that the investment valuation of the platform rose to $ 740 million.

Note that Bakkt has successfully launched testing of bitcoin supply futures, but so far has not received permission from the Commission on Urgent Stock Trading in the United States (CFTC) to start full-fledged trading.

It is expected that the launch will take place in the third quarter, but in the past the event has been repeatedly postponed.

At the same time, Bakkt, according to media reports, is seeking to obtain a license of trust from the Financial Services Authority of New York (NYDFS).

Subscribe to the BlockchainJournal news in Telegram: BlockchainJournal Live – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news