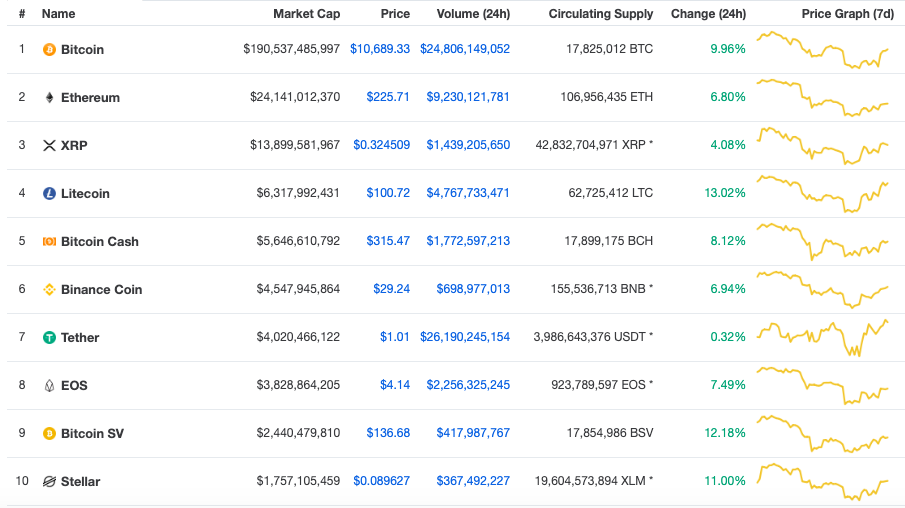

CoinDesk analyst Sebastian Sinclair came to the conclusion that all altcoins from the top ten CoinMarketCap run the risk of a further fall in price.

According to his observations, the most capitalized altcoins – Ethereum (ETH), XRP, Bitcoin Cash (BCH), Litecoin (LTC), Binance Coin (BNB), EOS, Bitcoin SV (BSV) and Stellar (XLM) – are trading below the 200-day moving average.

Thus, sellers dominate the altcoin market. At the same time, most investors prefer to sit out in a slightly less volatile bitcoin, as evidenced by its dominance index at around 69.1% .

Daily charts with MA 200 for Ethereum, Litecoin, Stellar and Bitcoin Cash

It is worth noting that the prices of most coins from the top 10 fell below this key line in July. The exception is BCH, which broke through the MA 200 at the end of August.

It is unlikely that the current state of things inspires optimism for the supporters of diversified portfolios – in order to continue the market recovery, altcoin prices have to overcome serious resistance.

For example, on the Litecoin chart, the so-called “death cross” is observed – the intersection of MA with periods of 50 and 200 on the daily chart:

TradingView LTC / USD chart

This intersection is interpreted by many investors as a reliable signal to continue a strong fall in prices. It is noteworthy that the “digital silver” death cross took place shortly after the halving of the block reward.

The market dynamics since the beginning of August are illustrated below:

Data: coin360

As you can see, the popular altcoins sank much deeper during the month than BTC.

Earlier, analyst Omkar Godbow expressed the view that August for Bitcoin will be the third month this year with negative dynamics.

Subscribe to BlockchainJournal news in Telegram: BlockchainJournal Live – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news