Según se informa, Bitstamp, uno de los exchanges de criptomonedas más antiguos, planea expandir sus operaciones y servicios a través de un nuevo plan de recaudación de fondos. El exchange,…

Bitstamp

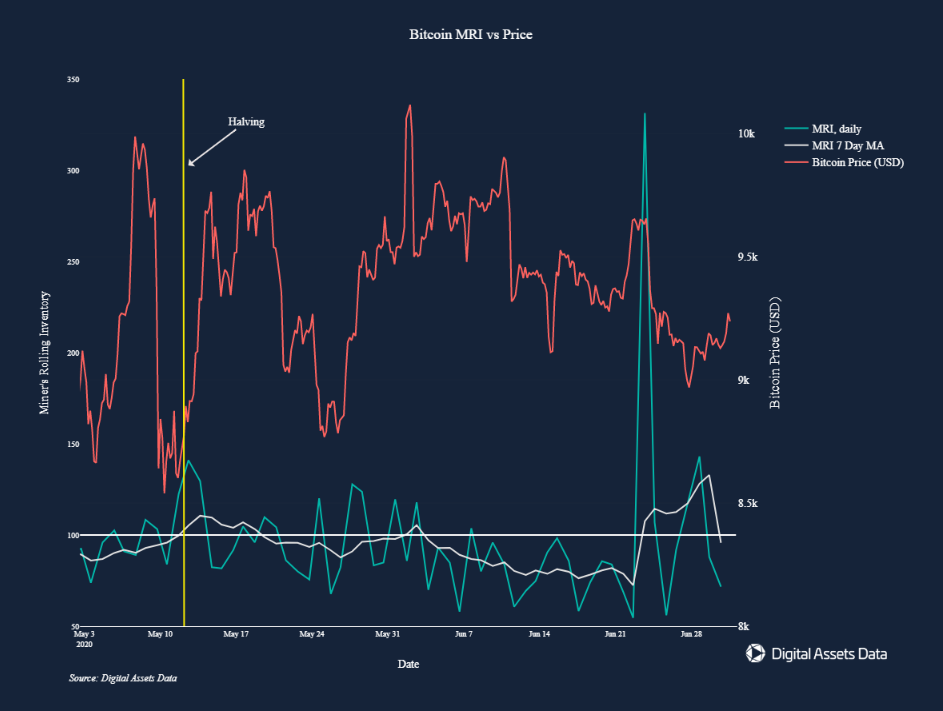

The head of the platform and co-founder of Digital Assets Data, Mike Alfred, in a conversation with the Cointelegraph admitted that miners could be behind the sharp fluctuations in bitcoin at the end of June.

“It's hard to say for sure, but it seems to me that the actions of miners have a direct and immediate effect on the price. This is especially noticeable in the events falling out of the general series, as happened on June 23. On this day, miners sold three times as many bitcoins as they mined, ”the expert shared his thoughts.

On June 18, Alfred drew attention to a marked decrease in the indicator of miners' confidence in growth (MRI) after halving . In other words, at that time, this group of market participants began to hold more than to sell the mined cryptocurrency. Five days later, MRI took off, indicating an increase in sales, which could be one of the reasons for Bitcoin's weakness in recent days.  Bitcoin has been trading in a narrow range of $ 9,000 – $ 10,000 over the past two months and is now close to its lower limit. On Thursday, for a short time, the price fell below $ 9000, but by now it has returned to $ 9100 (Bitstamp data). Recall, the day before, analyst Dmitry Perepelkin analyzed the technical picture of bitcoin and allowed a possible drop in prices to at least $ 8600. Subscribe to ForkLog news on VK !

Bitcoin has been trading in a narrow range of $ 9,000 – $ 10,000 over the past two months and is now close to its lower limit. On Thursday, for a short time, the price fell below $ 9000, but by now it has returned to $ 9100 (Bitstamp data). Recall, the day before, analyst Dmitry Perepelkin analyzed the technical picture of bitcoin and allowed a possible drop in prices to at least $ 8600. Subscribe to ForkLog news on VK !

The Chicago Mercantile Exchange (CME Group) introduced specifications for bitcoin options, the launch of which is expected in the first quarter of 2020. Get ready for the launch of options on Bitcoin futures in Q1 2020. See contract specifications now: https://t.co/iI1Yi0csGW pic.twitter.com/4UPH5kKsHH – CMEGroup (@CMEGroup) October 30, 2019 The site says that new instruments will be calculated and based on CME CF Bitcoin […]

The Chicago Mercantile Exchange (CME Group) introduced specifications for bitcoin options, the launch of which is expected in the first quarter of 2020. Get ready for the launch of options on Bitcoin futures in Q1 2020. See contract specifications now: https://t.co/iI1Yi0csGW pic.twitter.com/4UPH5kKsHH – CMEGroup (@CMEGroup) October 30, 2019 The site says that new instruments will be calculated and based on CME CF Bitcoin […]

5/5 (1 voto) La criptomoneda nunca es aburrida, y en los últimos dos días, Bitcoin (BTC) lo ha demostrado una vez más. La moneda líder, cuyo precio se ha consolidado…

Today, October 25, the price of the first cryptocurrency made a sharp jump above the $ 8600 mark. The chart below shows that the sharp movement of more than $ 1000 (> 15% from previous marks in the region of $ 7400) occurred against the backdrop of a significant increase in trading volumes: According to Rekto, over the last 24 hours positions on the largest crypto derivative exchange BitMEX were liquidated at $ 200 […]

Today, October 25, the price of the first cryptocurrency made a sharp jump above the $ 8600 mark. The chart below shows that the sharp movement of more than $ 1000 (> 15% from previous marks in the region of $ 7400) occurred against the backdrop of a significant increase in trading volumes: According to Rekto, over the last 24 hours positions on the largest crypto derivative exchange BitMEX were liquidated at $ 200 […]

Tron-based USDT tokens account for more than 12% of the total offer of the most popular stablecoin. According to Tronscan, to date, 520 million Tether “stable coins” have been issued on the Tron blockchain. Given the current supply volume of Tether (4.1 billion USDT), the share of TRC20 tokens in it is 12.65%. A significant increase in the share of USDT of the new standard occurred today, October 25th. At first […]

Tron-based USDT tokens account for more than 12% of the total offer of the most popular stablecoin. According to Tronscan, to date, 520 million Tether “stable coins” have been issued on the Tron blockchain. Given the current supply volume of Tether (4.1 billion USDT), the share of TRC20 tokens in it is 12.65%. A significant increase in the share of USDT of the new standard occurred today, October 25th. At first […]

El servicio de custodia BitGo proporcionará una solución para el almacenamiento seguro de fondos criptográficos administrados por la plataforma de negociación Bitstamp. Según un comunicado de prensa, el proceso de…

On Tuesday, September 24, the price of bitcoin at high volumes fell from $ 9400 to $ 8070. At the same time, quotes fell by $ 1,400 in less than two hours – from 18:00 to 20:00 UTC. Losses of some altcoins at this moment reached 30-50%. For the first time since mid-June, Bitcoin dropped below $ 9,000 and is currently trading at around $ 8,500 at the time of writing. […]

On Tuesday, September 24, the price of bitcoin at high volumes fell from $ 9400 to $ 8070. At the same time, quotes fell by $ 1,400 in less than two hours – from 18:00 to 20:00 UTC. Losses of some altcoins at this moment reached 30-50%. For the first time since mid-June, Bitcoin dropped below $ 9,000 and is currently trading at around $ 8,500 at the time of writing. […]

En Rusia, las operaciones con criptomonedas aún no están reguladas legalmente y, por lo tanto, por sí mismas, no violan nada. Sin embargo, a partir del 1 de enero de…

The latest steps of the Federal Reserve System (FRS) in the foreign exchange market may cause a new wave of bitcoin price growth. This opinion was expressed by a number of well-known representatives of the cryptocurrency industry. On Tuesday, September 17, a sharp increase in rates on the repo market (securities purchase / sale transactions with an obligation to resell them) forced the Fed to resort to providing for the first time in the last ten years […]

The latest steps of the Federal Reserve System (FRS) in the foreign exchange market may cause a new wave of bitcoin price growth. This opinion was expressed by a number of well-known representatives of the cryptocurrency industry. On Tuesday, September 17, a sharp increase in rates on the repo market (securities purchase / sale transactions with an obligation to resell them) forced the Fed to resort to providing for the first time in the last ten years […]