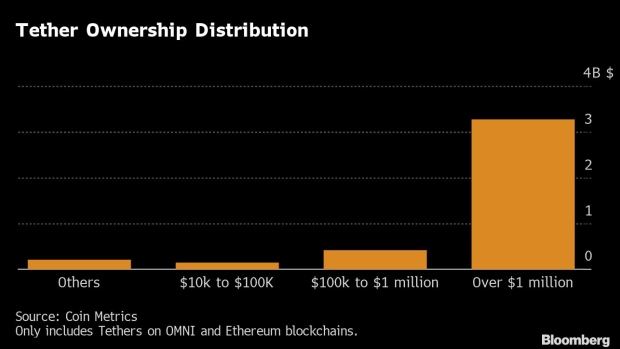

318 wallets contain more than $ 1 million in USDT stablecoins, which together account for about 80% of all issued coins. It is reported by Bloomberg with reference to a study by Coin Metrics.

Coin Metrics co-founder Nick Carter noted that the largest holders of USDT are brokers working with Chinese investors and high-frequency traders, as well as cryptocurrency exchanges such as Binance, Huobi and Bitfinex.

It is noteworthy that USDT was used to conclude 40% and 80% of all transactions precisely on Binance and Huobi, respectively.

The Coin Metrics study included USDT wallets based on the OMNI and Ethereum protocols.

“The concentration of Tether suggests that the control of the stablecoin is in the hands of several central players who can influence the fluctuation of the price of bitcoin, as well as the fact that many exchange players are interested in keeping Tether in the game,” said John Griffin, Professor, University of Texas at Austin

It is worth noting that, in comparison with Tether, bitcoin is much more distributed among holders. So, according to the BitInforCharts.com portal, at the moment, more than 20 thousand addresses control cryptocurrency worth more than $ 1 million.

Previously, Diar researchers found that more than half of the total volume of Tether on-chain transactions falls on Chinese exchanges.

Recall, recently Tether launched a stablecoin on Blockstream's Liquid Network, and also announced the launch of the USDT token on the Algorand blockchain. New assets will join the Tether family of stablecoins on the Bitcoin, Ethereum, EOS and Tron blockchains.

Subscribe to BlockchainJournal news on Telegram: BlockchainJournal Feed – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news