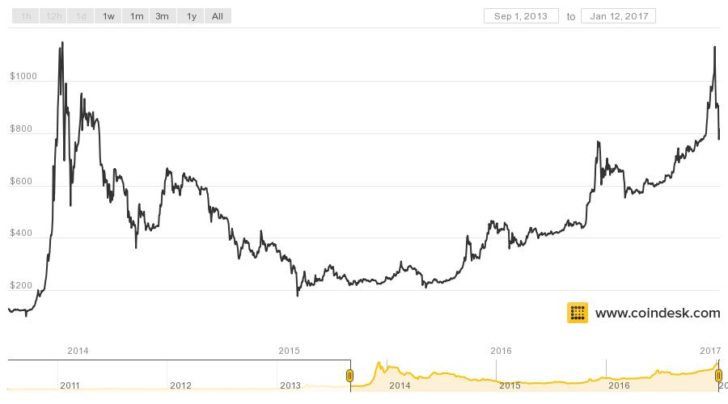

The rapid drop in the price of bitcoin in the past few days is a clear illustration of the concerns of the US Securities and Exchange Commission (SEC). This was written on Twitter by American lawyer Jake Cherwinski, specializing in cryptocurrencies.

– bitcoin drops 20% over a few days

– there's no simple explanation for why

– the drop made big money for offshore unregulated margin trading platforms

– trading on those same platforms might've caused the drop in the first place

– you're still wondering why the SEC has concerns?– Jake Chervinsky (@jchervinsky) September 25, 2019

He pointed out the connection between the decline in the price of the first cryptocurrency and the increase in profits on unregulated offshore platforms with the possibility of margin trading.

“And you continue to wonder why the SEC has doubts?” Cherwinski added.

The lawyer noted that the problem of SEC distrust in Bitcoin-based ETFs can be resolved if trading volume is concentrated in regulated markets. Nevertheless, there are already many instruments operating in such markets, but volumes are still concentrated mainly in offshore.

“They [platforms] profit from volatility, which leads to increasing volumes and liquidations. Calm markets do not make them money. ”

In his opinion, the SEC can perceive such things as manipulations and dissuade the agency in this, based on the data of the technical analysis, it will not work. The latter generally can not fully explain the movement of the price of bitcoin, summed up Cherwinski.

It's amusing to see all the responses in which people think bitcoin's price movements can be * fully explained * by technical analysis, as though a mere deterministic function of patterns on a chart, wholly immune to the tedium of reality. If true, of course, they'd be rich by now. https://t.co/3baOhb9KfY

– Jake Chervinsky (@jchervinsky) September 26, 2019

Earlier, the lawyer said that the chance of approval of Bitcoin-ETF SEC by Bitwise does not exceed 0.01%.

Follow BlockchainJournal on Twitter !

BlockchainJournal.news

BlockchainJournal.news