The Financial Services Agency of Japan (FSA) intends to oblige cryptocurrency exchanges to strengthen security measures through more careful control over cold storages, Reuters reported, citing informed sources.

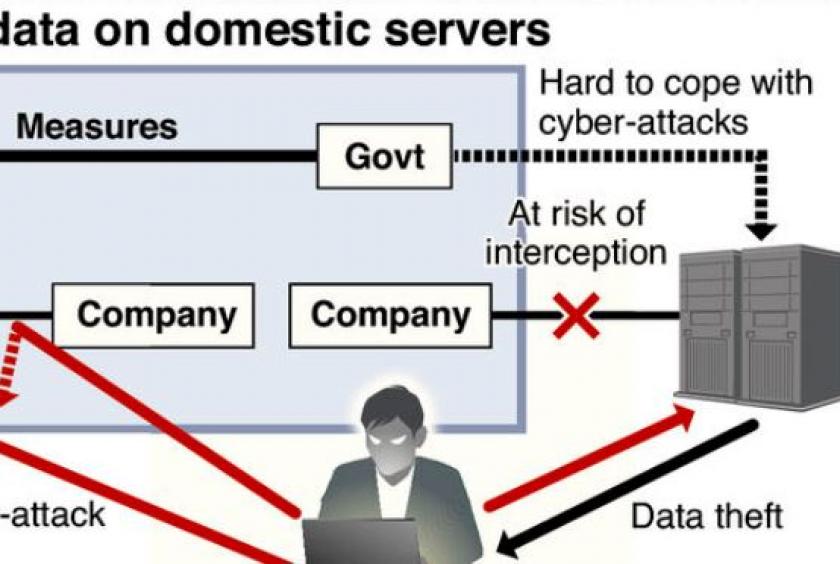

The Office found that even if the trading platform is well protected from external attacks, there is a risk of internal sabotage. So, the FSA is concerned about the rules of access for those in charge to cold storage facilities.

In Japan, 19 cryptocurrency trading sites have received permission to operate, but not all of them are currently active.

Recall that at the end of last year, the authorities published rules that should be followed by cryptocurrency service providers.

The report identifies nine areas that should be considered in connection with the activities of cryptocurrency exchanges and other service providers in this area.

The rules relate to such areas as burglary incidents, listing of cryptocurrencies on stock exchanges, disclosing financial and price information, margin trading and custodial services.

Japanese authorities have formulated the rules of the Bitcoin exchanges https://t.co/Kc5xRxMw4X # Japan # Bitcoin # cryptocurrency pic.twitter.com/5lWMewjQQP

– BlockchainJournal (@BlockchainJournal) December 29, 2018

The amendments to the law “On financial instruments and exchanges” approved by the Council of Ministers of Japan also state that the amount of leverage when trading in cryptocurrencies should not exceed the deposit more than 4 times. These changes will take effect by April 2020.

Subscribe to BlockchainJournal on YouTube !

BlockchainJournal.news

BlockchainJournal.news