The famous Harvard University became one of the investors of the New York blockchain-company Blockstack, directly investing up to $ 10 million in the project. In particular, this was noticed by Anthony Pompiano, CEO of the Morgan Creek Digital Asset Management Fund.

BREAKING: Harvard's endowment invested $ 5M – $ 10M directly into Blockstack's token sale.

One of the leading university endowments is comfortable holding directly tokens.

THE VIRUS IS SPREADING

– Pomp ? (@APompliano) April 11, 2019

According to him, such a move by Harvard indicates that one of the leading universities in the world is quite supportive of cryptocurrency tokens.

An application for holding a tokensail in accordance with the established “A +” provision to the United States Securities and Exchange Commission (SEC) Blockstack filed earlier this week . The company plans to attract $ 50 million in funding through the sale of 295 million Blockstack Stack (STX) security tokens.

The tokens are divided into two baskets: 215 million tokens at a price of $ 0.12 per unit for early holders of vouchers and 40 million tokens at a price of $ 0.30 per unit for qualified investors. Another 40 million tokens were allocated for non-cash consideration provided by the App Mining program.

As The Block points out , the company has already sold 323 million tokens to 24 accredited buyers, who are Blockcast PBC shareholders, at a price of $ 0.00012 per unit. The initial issue of STX tokens took place in November 2017 and, according to the publication, allowed the Blockstack early investors to convert their shares.

Accordingly, in theory, these early investors have a good chance to significantly increase their investments in the project. If you focus on the specified prices of a tokensil, then with respect to a basket of tokens at $ 0.12 a profit can be 1000 times more than the initial investment, in the case of a basket at $ 0.30 – more than 2000 times.

We add that information that Harvard University has invested in the Blockstack is also contained in the application filed with the SEC. According to the document, the organization represented by the Harvard Management Company and two other investors, Lux Capital and Foundation Capital, acquired 95,833,333 tokens.

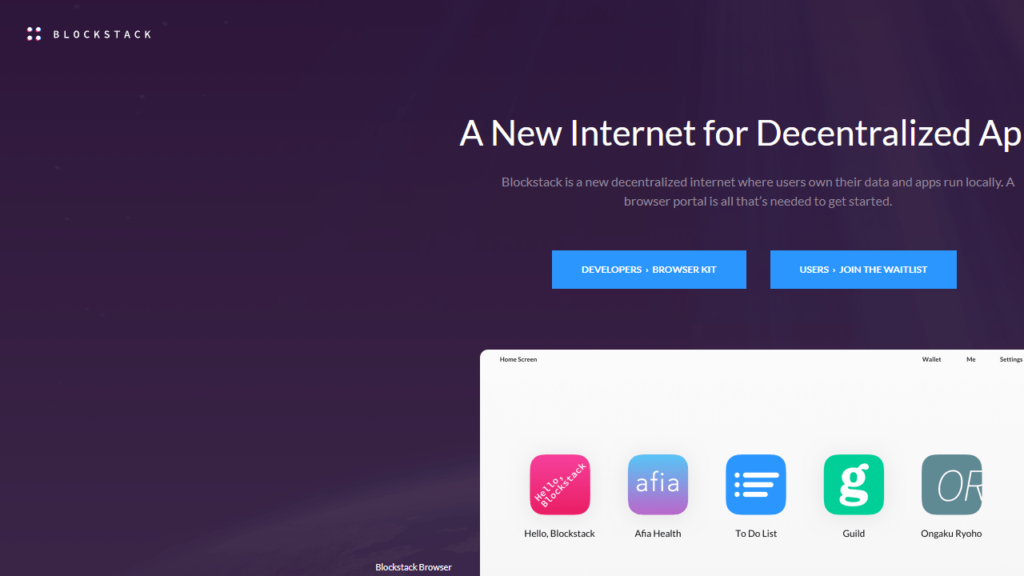

The Blockstack Company was established in 2013 and was originally called Onename. The project, which is also known for its work on the decentralized Internet, managed to attract $ 50 million of investment from well-known representatives of the blockchain industry and venture capital firms.

In February of this year, Blockstack reported on ongoing work on a new distributed protocol called Stacks , which uses the bitcoin power of the Bitcoin network in combination with the Proof-of-Burn mechanism (PoB).

Subscribe to the BlockchainJournal news in Telegram: BlockchainJournal Live – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news