The Chicago Mercantile Exchange (CME) informed its customers that May was the most successful month for Bitcoin futures. So, on May 13, a record trading volume of 33,677 contracts was recorded ($ 1.3 billion in BTC). At the same time, the daily average also updated a maximum of 14,000 contracts.

CME Bitcoin futures reached an all-time record high of 33.7K contracts on May 13 (168K equivalent bitcoin), up nearly 50 from the for last% record of 22.5K Contracts on April 4. See how market Participants are using the $ The BTC to the manage Uncertainty : https://t.co/hDgraMj5pe pic.twitter.com/ct1xkjoJDF

– CMEGroup (@CMEGroup) May 13, 2019

At the same time, the number of accounts trading in this derivative has also grown – now there are more than 2500 of them.

The Block Data

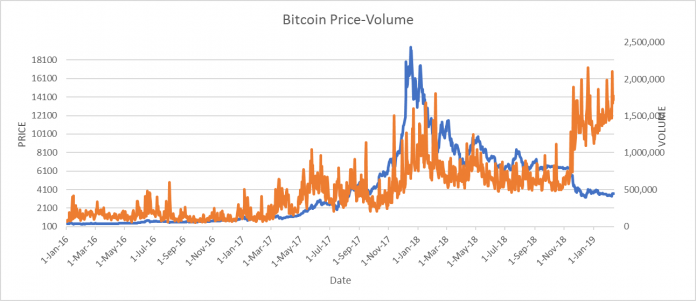

“Since December 2017, our exchange processed 1.6 million contracts for Bitcoin (over 8 million BTC or $ 50 billion +),” the CME reported.

Note that over the past 24 hours, trading volume at CME was $ 408 million. According to Bitwise Asset Management , this is higher than all the spot markets for Bitcoin, except for Binance.

Recall that in March of this year, the Chicago Option Exchange (CBOE) refused to add new Bitcoin futures. The longest CBOE contract will last until June.

The previous record for CME was recorded on April 4th. Then there were 22,542 contracts traded on the stock exchange.

Subscribe to the BlockchainJournal news in Telegram: BlockchainJournal Live – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news