The cash flow index (MFI), which is based on Bitcoin price and trading volume, signals that the first cryptocurrency has hit bottom in December 2018. This was reported by analysts CoinDesk Markets Omkar Godboul.

The task of the MFI is to determine the advantages of buyers or sellers in the market. The indicator oscillates in the zone from 0 to 100: the growth of the MFI indicates the strengthening of the position of the bulls, and the fall – the prevalence of negative sentiment. However, Godboul stressed that MFI quite often deviated from the market trend.

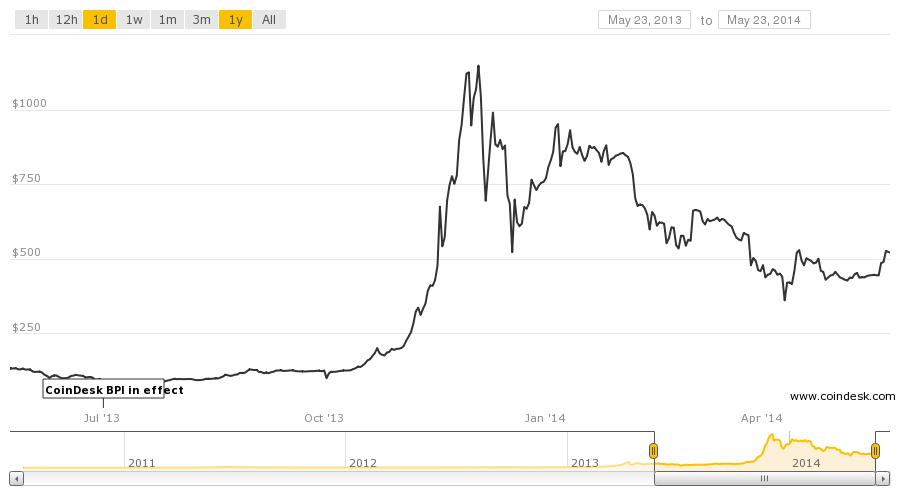

When the price of Bitcoin fell below $ 6,000 in mid-November 2018 and reached an annual minimum of $ 3,122 in a month, the 14-week MFI also showed a fall from 43.

However, the indicator, unlike the price of the asset, did not update the minimum, but stopped at 22. Thus, a bullish divergence emerged in the market, foreshadowing a trend change.

In February, when the price of Bitcoin rose by 10%, the MFI reached the mark of 44, confirming, in the opinion of Godboul, the fact that the bottom had been passed. The intersection of moving averages (MA) with parameters of 50 weeks and 100 weeks also speaks in favor of such a development of events.

So, Godboul is sure, the indicators confirm the growing probability of rally closer to halving.

CoinDesk Markets analyst Sam Umet added that the MACD indicator also speaks in favor of bulls; the histogram reached the highest level since January 2018 at 102.38.

As of 7:00 UTC, bitcoin is trading at around $ 3,750.

Recall that on Monday, March 4, the capitalization of the cryptocurrency market fell by $ 4 billion.

Subscribe to the BlockchainJournal news in Telegram: BlockchainJournal Live – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news