for ten years

The first cryptocurrency appeared in the midst of the deepest crisis since the Great Depression. All this time, Bitcoin has grown almost simultaneously with the S & P 500 index, often called the “barometer of the American economy.”

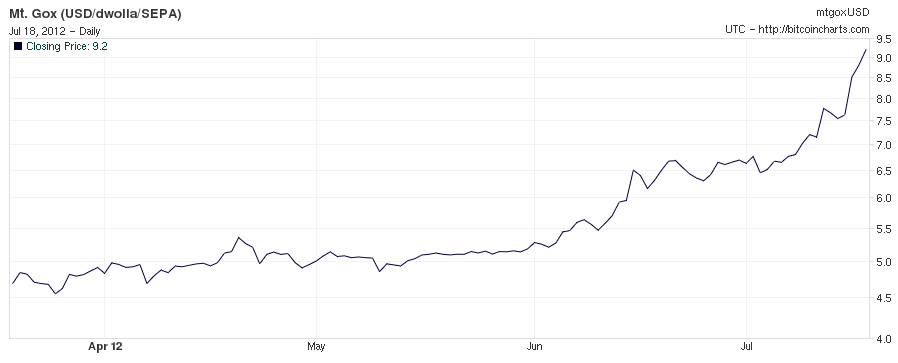

The graph below shows that the emergence of cryptocurrency almost coincided with the bottom of the previous crisis:

Monthly S & P 500 stock index chart from TradingView

With the advent of “digital gold,” a confident recovery of the American economy began, fueled by quantitative easing . In developed countries, there has been a ten-year period of growth, low inflation and high prices for many assets.

However, now many experts are confident that the world is on the verge of another global crisis. So, the graph below shows the ratio of the value of the exchange goods index to the S & P 500:

This figure is now at a 50-year low. In the past, when this ratio was at extremely low values, followed by a long-term period of stagnation of the stock market.

For example, the previous low was followed by the collapse of the index of high-tech companies NASDAQ Composite. It is noteworthy that now the ratio of the value of the commodity index to the S & P 500 is even lower than on the eve of the collapse of the dotcoms – at about 1972 levels. Then, half a century ago, the so-called “bubble of the Nifty Fifty ” was formed, that is, the fifty most popular stocks of American companies in the 60-70s, distinguished by rapid growth and price-earnings ratio .

It is also worth noting that in recent months there has been a pronounced inverse correlation between Bitcoin and the S & P 500:

This may indicate that an increasing number of investors are using “digital gold” as a hedging instrument in the face of increasing global uncertainty.

Thus, with the exception of the first year of life, Bitcoin did not exist during periods of global recessions. This makes many market participants think about how the first cryptocurrency will lead in the new conditions, amid uncertainty and panic associated with sharp price fluctuations of traditional financial assets. Thus, according to analysts at Grayscale Investments, the gaining momentum in the US-Chinese trade will continue to influence the price of bitcoin.

Recall in more detail about the impact of the trade war between China and the United States on the price of Bitcoin and the industry as a whole can be found in the exclusive BlockchainJournal via the link .

Subscribe to BlockchainJournal news on Facebook !

BlockchainJournal.news

BlockchainJournal.news