On Saturday, the BTC rate dropped another 8%, some skeptics immediately declared that the promising rally was over. Many analysts, however, remain calm and still hope that the cost of Bitcoin will still rise to a new price high.

Currently, most of the short-term forecasts for the BTC-price remain bearish. In 2019, Bitcoin set a new annual price high of $ 13,739. So, we can say that the rate has fallen off by 33%. Despite the bearish short-term forecasts, which suggest that the cryptocurrency will trade for some time around $ 7,500- $ 8,500, analysts believe that in the long run, BTC will still be able to surprise the crypto-society.

Three factors that affect the optimistic attitude of analysts

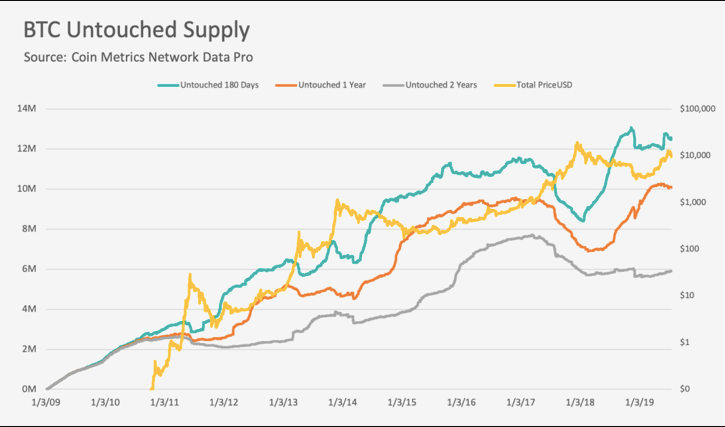

- The number of inactive Bitcoin addresses has reached a new maximum

Over the past 5 years, the number of inactive Bitcoin addresses has increased, the funds that are saved there have not moved from 180 days to 2 years. This data suggests that Bitcoin is perceived more as a means of preserving value.

- Start of a new bull rally coincides with the period of the surrender of miners

According to PlanB's crypto-analytics, the start of the new bull rally coincided with the so-called surrender of miners – an analysis shows that there is a tendency for 100x growth. Currently, BTC dynamics reflects cycles that are relevant in the past. From the moment when BTC reached its low at the end of last year, the BTC rate has already risen by more than 300%.

Difficulty bottoms after downward adjustments (dark blue: Dec2011, May2015, Dec2018) mark the start of a bull run. Around 2-3x at 30k blocks), there’s some struggle, like right now. Then price goes parabolic (green). Top at around 120k blocks. pic.twitter.com/1QqBlXo6Jl

PlanB (@ 100trillionUSD) July 27, 2019

- HYIP before HALIVING BTC can become a trigger for price growth to $ 20,000

Recently, popular crypto analyst Filb Filb said that despite a correction in the Bitcoin market, it will not exactly return to the minimum of $ 3,120.

6 / Mid term Action most likely from miners:

– Sell production / Hedge down while existing MC is still low

– Limit selling pre halving to envoke new halving bubble

– Limit sale of production

– Maximize revenue per unit

– Sell new bubblefil₿fil₿ (@filbfilb) July 17, 2019

He explained that miners sell BTC, guided by market demand every time the remuneration exceeds mining costs. However, it is expected that they will begin to restrict sales before halving, thereby contributing to the emergence of a new bubble.