How does complexity affect mining profitability?

The graph below shows that in 2017 began a sharp increase in the complexity of mining Bitcoin. It stopped only in November 2018, when a sharp collapse of the market occurred. At the same time, a decrease in the hashrate was observed.

Source: Blockchain.com

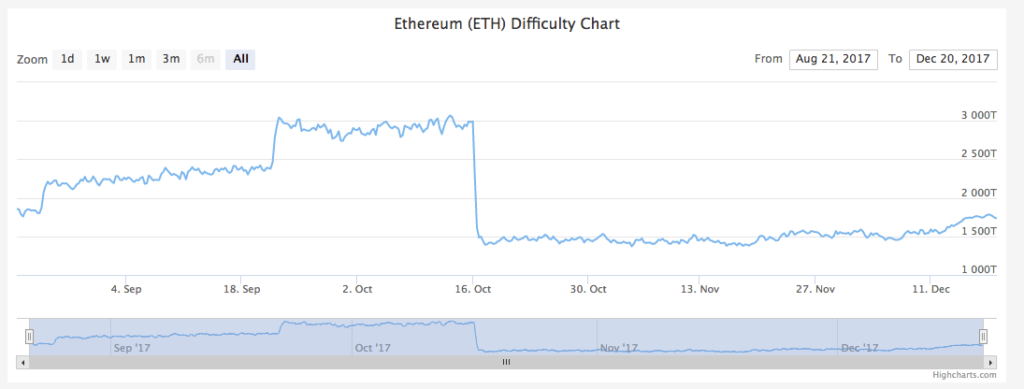

A similar picture is observed in other most liquid cryptocurrencies. At the same time, experts recently estimated the average monthly increase in the complexity of leading altcoins at a rate of 8%. Since then, the situation has changed somewhat, but, if we rely on these figures, then with an 8 percent increase in complexity within one month, the profitability of mining capacities already after 9 months will approach almost zero value.

Regarding the break-even point for bitcoin mining, then at the end of 2018 some analysts said that with the current complexity level, the first cryptocurrency should cost at least $ 7,000 (when mining on Bitmain S9 Antminer devices).

Thus, in an environment where the price of Bitcoin dropped to $ 4,000, users need to either acquire even more expensive equipment, or switch to mining cryptocurrency with lower levels of difficulty. The first decision may be too expensive, the second – quite risky. The best option could be the so-called "golden mean", that is, mining cryptocurrency with an average level of complexity. Many, however, prefer to turn off the equipment altogether, hoping to wait out the period of market decline, or find alternative ways to use it.

BlockchainJournal.news