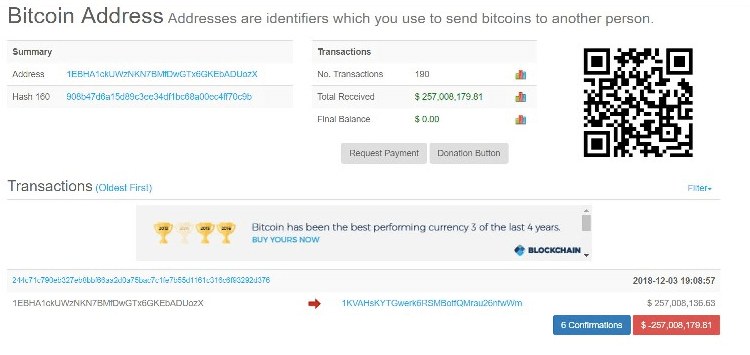

Last night, 66 233 BTC were sent from one of the twenty richest Bitcoin addresses, worth just over 257 million US dollars. It is worth noting that this address has not been active since 2014.

At the moment, the destination is unknown. This is most likely an over-the-counter address, since such huge amounts can very easily cause serious market unrest. The number of bitcoins that were sent exceeds even the volume of cryptocurrency trading over the past days at Binance – $ 205 mil. and Bitfinex – $ 155 million.

Below is a screenshot of this transaction (still unconfirmed):

It is worth noting that the transaction fee is only $ 43. Where else can you send $ 257 million for less than $ 50?

Another interesting fact is that the transaction has been divided into many SegWit addresses. The reason may be to complicate the tracking of funds.

What could be the result of transferring such a huge amount of BTC? If the destination is an over-the-counter market, then there should not be a significant impact on secondary markets (exchanges). This is due to the fact that for each transaction there are two sides – the buyer and the seller.

In a less likely scenario, the destination is an exchange, then the situation can change a lot for BTC. This can be a price manipulation and can lead to a reset of the cryptocurrency price to $ 3,000. We must not forget that any seller, especially someone who sells such an amount, would like to maximize the average selling price, and not to maneuver the price.

And what do you think about this? Leave your comments below!