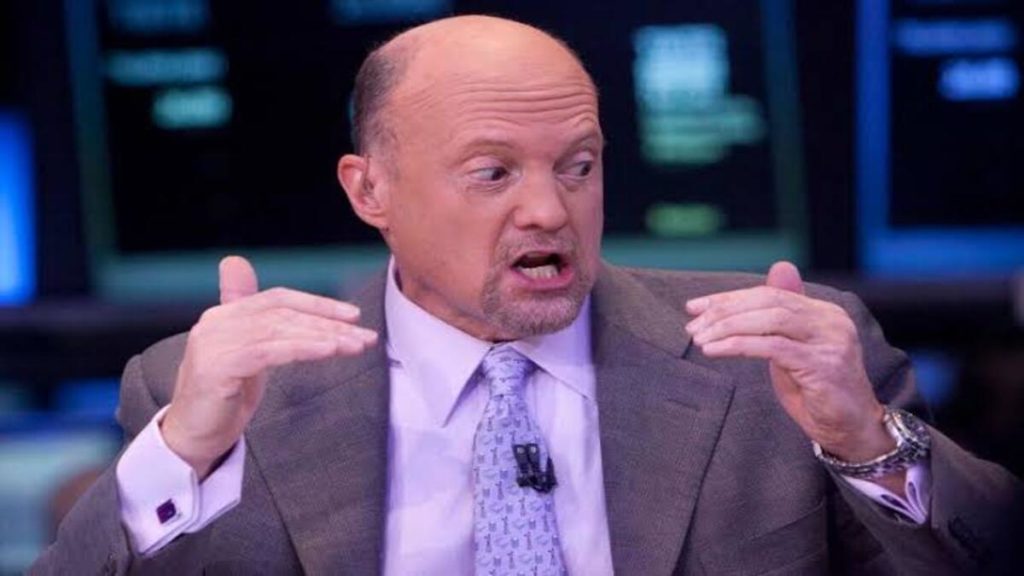

Against the backdrop of the popularity of the host of CNBC’s Mad Money Jim Cramer, a Connecticut-based advisory firm, Tuttle Capital Management, has filed and submitted a preliminary prospectus with the United States Securities and Exchange Commission (SEC) as per report.

Tuttle Capital Management’s new filing with the SEC contains two new Exchange-Traded Funds (ETFs), which revolve around betting against the investment tips offered by Jim Cramer.

However, the firm discloses that the ETF will entail a short ETF known as Inverse Cramer ETF (SJIM), and a long ETF called Long Cramer ETF (LJIM).

In recent times, Cramer has become so popular and associated with a series of meme projects in the crypto and stock spaces. He has also been likened to doling out investment tips that end up being way off the mark.

One of the most viral investment tips offered by Cramer was to buy Coinbase stock when it was very supposedly cheap at $248 around August last year. Surprisingly, COIN has significantly dropped and is currently valued at $72.97 per CoinMarketCap report.

In line with the Oct. 5 preliminary prospectus SEC filing, Tuttle Capital Management would be able to commence a short ETF named Inverse Cramer ETF (SJIM) and a long ETF called Long Cramer ETF (LJIM) if eventually approved by the regulatory agencies.

The firm emphasizes that it would focus on the opposite position presented by the popular tv presenter Cramer and every activity will be largely stock-based and not crypto assets.

While the action of Tuttle Capital Management firm came to many people as a surprise, Bloomberg’s senior ETF analyst Eric Balchunas revealed that he was not surprised because he had contemplated and pushed for something related back in February.

Reviewing Tuttle Capital’s Unusual ETFs

While filing an ETF with the SEC without Cramer’s awareness is unusual, the Tuttle Capital Management is no longer new to creating a scene.

The firm once created an unusual scenario by launching an inverse ETF on the Nasdaq stock exchange called the Turtle Capital Short Innovation ETF (SARK) last year.

The decision was described by the Tuttle Capital CEO Matt Tuttle as a novel thing that has never occurred before.

It should be noted that there are many other firms filing for ETF approval. Grayscale recently filed for an ETF with the SEC and it is still awaiting the authorities approval.