Solana approved Alpenglow, a consensus overhaul that could move faster than Google by cutting finality to about 100–150 milliseconds. This reduction from the current ~12.8 seconds would reshape on-chain DeFi, payments, and gaming, also affecting traders, developers, and institutional investors, as Jina reports. Finality is the moment a transaction cannot change.

Consensus redesign and performance

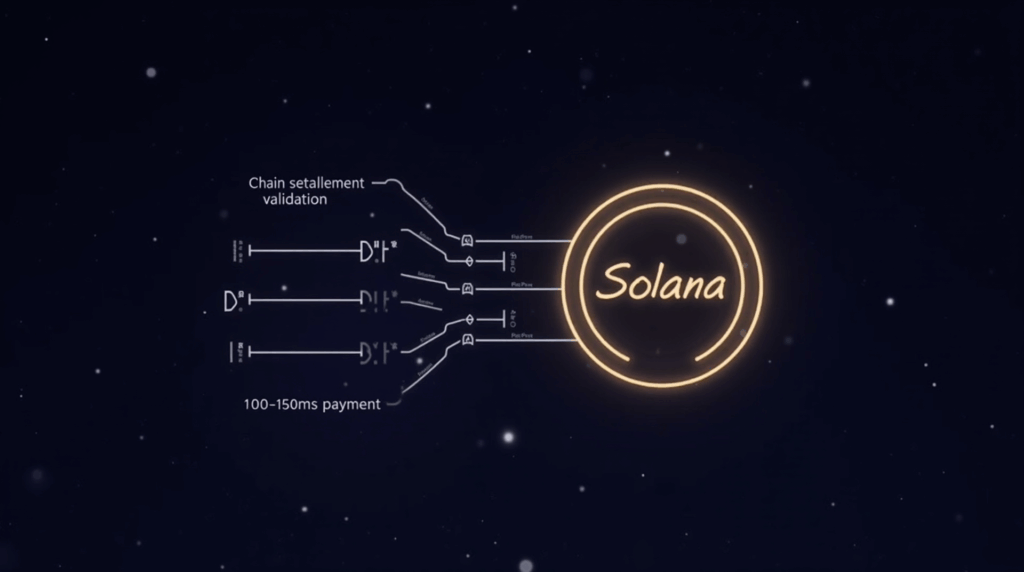

Alpenglow introduces two main parts — Votor for voting and block finalization, and Rotor for data dispersal. Jina states that they replace parts of the old design, such as Proof-of-History and TowerBFT. This new design creates an engine that shows latencies below 200 ms, setting a target of 100–150 ms versus Solana’s current ~12.8 seconds and Sui’s ~400 ms. The validator community showed broad support with about 98–99% approval and participation reported near 52%, according to Jina’s collection of votes and reports.

- The finality target is 100–150 ms.

- Current finality is about 12.8 s, while the competitor Sui has about 400 ms.

- Governance support is about 98–99% of validators, with participation near 52%.

- The economic aspect includes a VAT of 1.6 SOL per epoch, with fees burned, as the proposal states.

Economics, risks, and timeline

The proposal adds a Validator Admission Ticket (VAT) requiring 1.6 SOL per epoch, with fees burned to balance inflation. Jina warns that “the devil is in the details,” noting setup challenges and that, despite a “20+20” fault tolerance model, Alpenglow does not fully remove the risk of network problems.

If sub‑200 ms finality is achieved, DEX risk calculators and matching engines could operate at near centralized‑exchange speeds. On-chain games would gain real-time use, cross-border payments could finish in seconds, and traders and institutions could see reduced slippage and execution costs, though competition for funds between chains could increase.

Risks to watch include potential validator gathering due to the VAT, operational weaknesses during placement, and a long testnet phase. All of this affects funding, open interest, and institutional capital inflows if the operation fails or faces delays.

Experts states a roadmap with a public testnet at the end of 2025 and a possible mainnet launch in early 2026. For traders and managers, the next operational point is the testnet phase, whose outcome will signal the technical credit and capital flows into SOL.

Alpenglow’s approval signals a bid for ultra‑low finality on Solana, but execution quality during testing and rollout will determine whether the promised performance and economic design translate into durable network advantages.