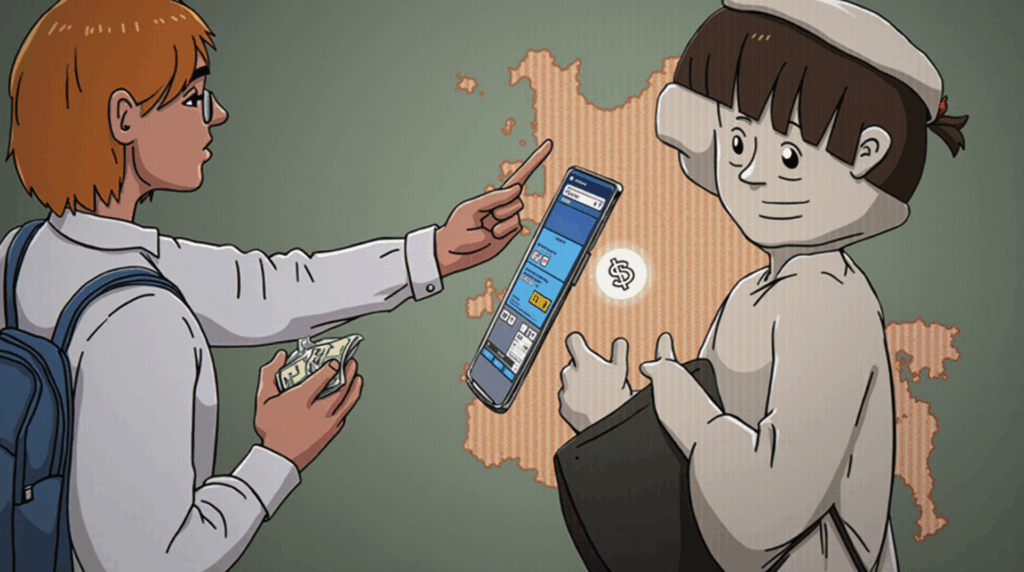

MoneyGram is integrating USD-pegged USDC on Stellar into a new app in Colombia to speed up remittances. The move aims to reduce friction for senders and receivers, protect against peso depreciation, and reshape payment infrastructure dynamics. At the same time, the shift raises regulatory and operational challenges that managers must assess.

How it works and early results

MoneyGram uses USDC settlement on the Stellar network to simplify cross-border transfers in Colombia, where access to a steady currency can help offset local savings erosion. Users can spend USDC via connected Visa/Mastercard cards and convert USDC to pesos at more than 6,000 MoneyGram locations, according to PR Newswire.

MoneyGram Ramps, an API for developers, streamlines compliant cash-to-crypto and crypto-to-cash services, as PR Newswire states. A stablecoin is a digital asset pegged to a fiat currency, and an on/off-ramp enables conversion between cash and crypto. “Crossmint helped a lot to speed up our stablecoin plan… it helped us move fast, remove many vendors in addition to launch the product sooner,” said Josh Bivins, Head of Product at MoneyGram, as reported by PR Newswire.

- Initial launch in Colombia with USDC on Stellar.

- Technical structure via Crossmint and card connectivity through Visa/Mastercard.

- MoneyGram Ramps API enables compliant on/off-ramps.

- Reach: 50+ million users and $42B moved annually.

Market, risk, and macro context

Using USDC for settlement may influence money movement and the gap between spot and OTC flows where MoneyGram operates, making it important for managers to watch conversion spreads and custody costs as signals of hedging quality. USDC use can offer a value base against peso depreciation in the near term, potentially reducing the need for frequent FX hedges. With over $42 billion in annual volume and more than 50 million customers across 200 countries, according to Crossmint/PR Newswire and MoneyGram’s account on X, the company’s scale could materially affect remittance corridors and liquidity in developing markets.

The initiative may create a local “parallel dollar,” shorten settlement times, and expand stablecoin adoption in key corridors. However, operational risks—fraud, tighter AML/KYC, and cybersecurity—remain significant, and press materials acknowledge prior challenges. For traders and operators, the main signal is faster movement between fiat and USDC in remittance channels, with direct implications for daily cash flow and conversion costs.

MoneyGram announced the solution in press releases dated Sept. 17, 2025; monitoring regional rollouts and evolving local regulations will be essential to gauge its impact on cash flow and operational risk.